Recommendations for Month End with LOU Accounting

These recommendations are based on the existing features in LOU and LOU Accounting. You and your accountant may determine your business requires a different Month End process. While we hope these recommendations will be helpful, we do not intend for this to be a “Month End feature”. You and your accountant should create a Month End process that best works for your individual business.

You don’t have LOU Accounting enabled? That’s ok! We have a recommendation for you, too.

If you need some recommendations for Year End activities, check this out.

Key Steps:

- Gather monthly financial statements

- Review and tie out General Ledger

- Reconcile General Ledger

- Reconcile Bank Statements and Merchant Clearing or Cash Clearing accounts

- Generate Financial Statements

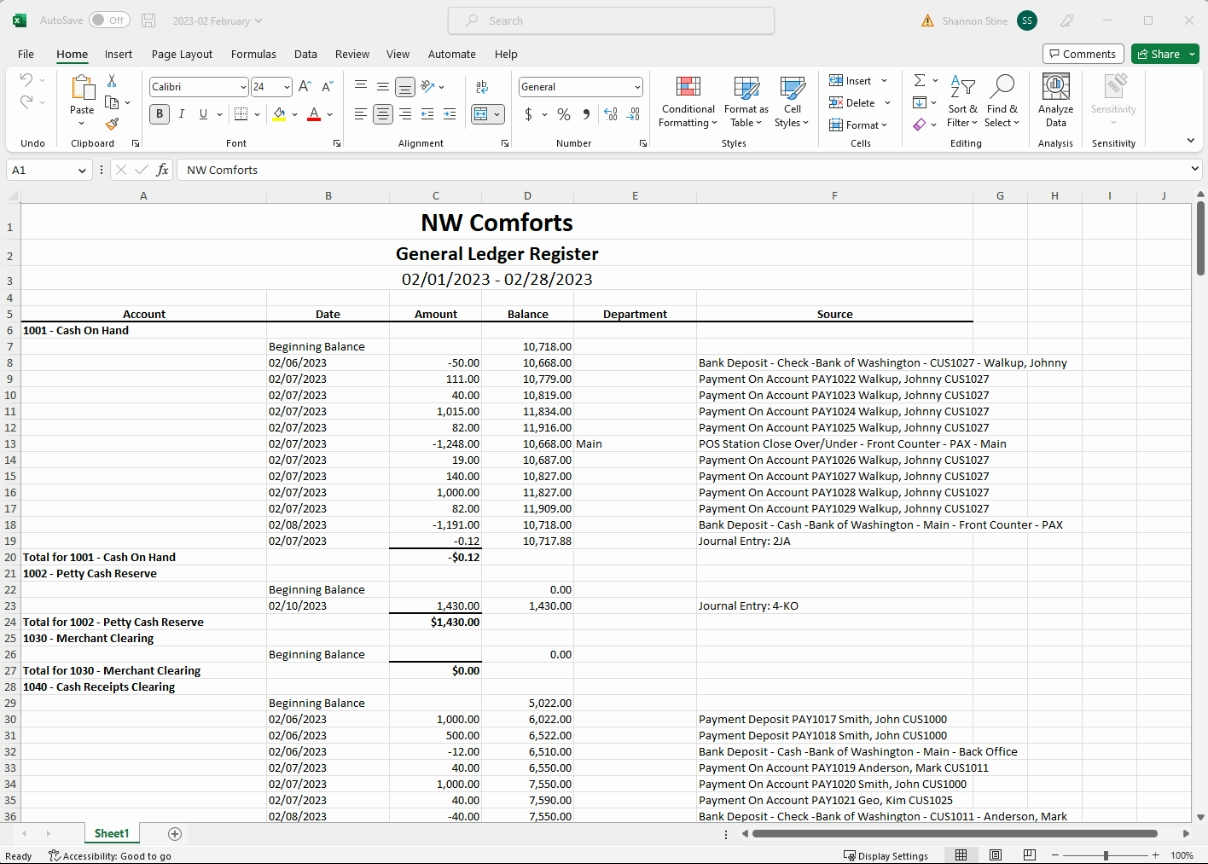

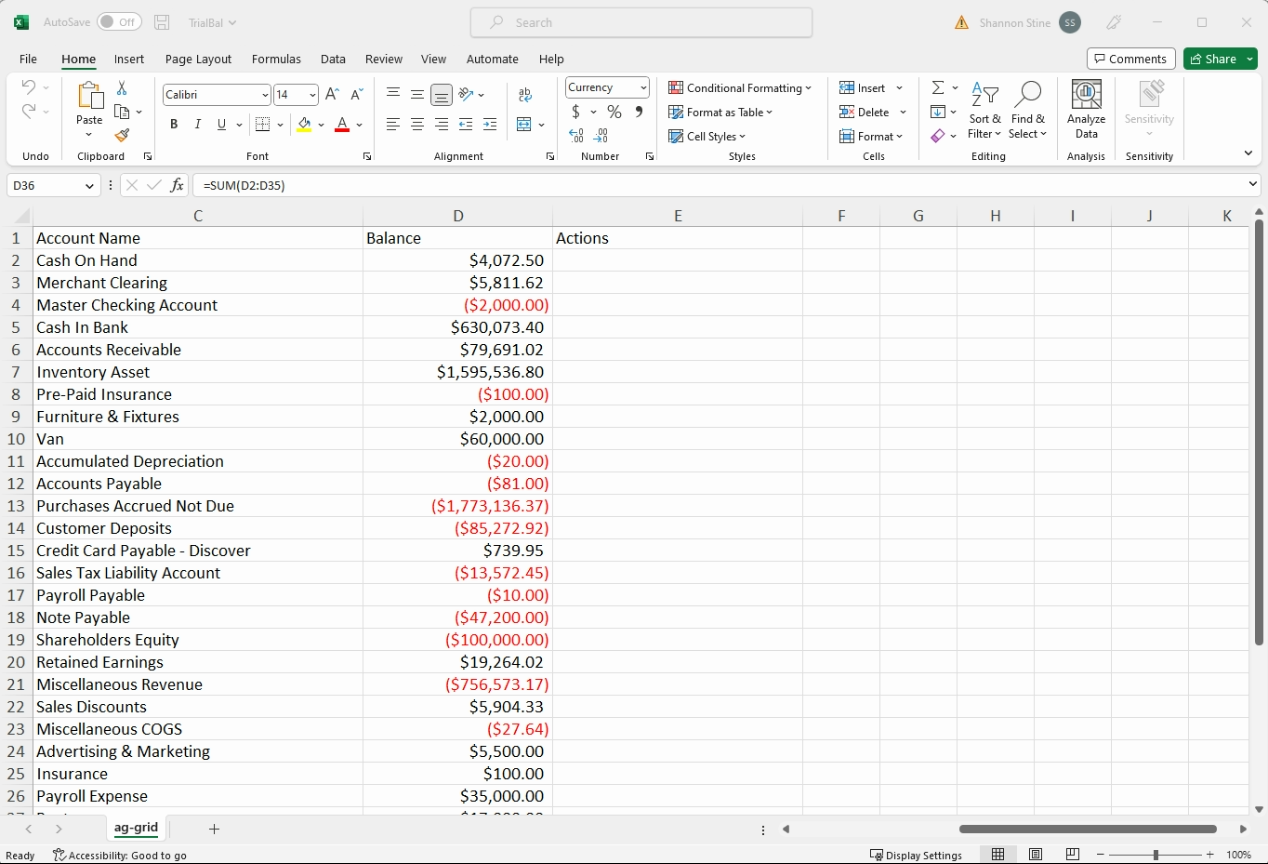

General Ledger Review

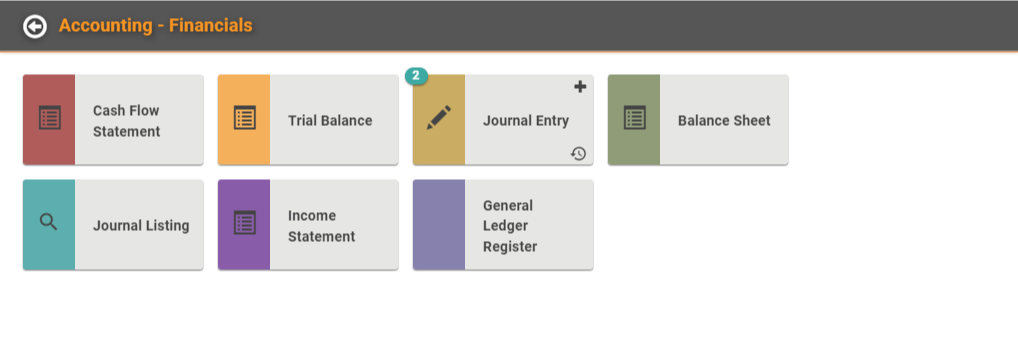

Tie out (balance) the General Ledger to Trial Balance, Balance Sheet, and Income Statement.

TIP! If you’re out of balance, look for potential changes in the prior Accounting Period.

Use the General Ledger to review account balances and quickly look at transactions. If something doesn’t look right or you need review a specific transaction, use the Trial Balance feature to easily drill down to the source.

General Ledger

Trial Balance

Balance Sheet

Income Statement

Common General Ledger Account Reconciliation

You must have something to verify the balance of your General Ledger Account against when you want to reconcile the account. LOU Accounting includes the following common subsidiary ledgers, or reports, to assist with month end balancing.

- Accounts Receivable Aging

- Operations / Reports / Accounts Receivable Aging

- Operations / Reports / Accounts Receivable Aging

- Inventory Valuation

- Operations / Reports / Inventory Valuation

- Operations / Reports / Inventory Valuation

- Accounts Payable Aging

- Operations / Reports / Accounts Payable Aging

- Operations / Reports / Accounts Payable Aging

- Pending Deposits

- Operations / Accounting / Pending Deposits

- REMEMBER! This is real time data only – current Pending Deposits. If Deposits have been applied to Invoices during the Month, they will not appear on this report. This is why this page is better for month end activities than the Customer Deposits report which may include deposits applied to Invoices.

- Tax Details

- Operations / Reports / LOUs Reports / Tax Details and choose the All Tax Details template.

- Operations / Reports / LOUs Reports / Tax Details and choose the All Tax Details template.

- Invoices with SKUs

- Operations / Reports / LOUs Reports / Invoices with SKUs

- IMPORTANT! You will need to make sure you’ve appropriately Mapped SKUs to Financials before you can use this report for month end balancing.

There are multiple ways you can reconcile these accounts.

- Account Reconciliation This feature allows you to complete a process like a bank reconciliation. While this feature will allow you to reconcile any GL Account, it is primarily intended to balance your bank statement to the appropriate GL tracking your cash in bank.

- We recommend performing Account Reconciliations monthly so you can keep everything balanced.

- IMPORTANT! Once you’ve completed the reconciliation, if you need documentation of this Account Reconciliation outside of LOU, you can export the list of transactions by right-clicking anywhere in the data and choosing Export and CSV or Excel. You will need to manually add the Ending Balance and General Ledger Account Name, as well as any images you’ve attached to the reconciliation.

- You can balance the subsidiary ledgers to the General Ledger by comparing the balances from the subsidiary ledger to the General Ledger, Balance Sheet, and Income Statement. If everything agrees (balances to each other), the account is reconciled!

- TIP! We encourage you to save the subsidiary ledger for historical purposes.

Bank and Merchant Clearing Account Reconciliations

You can use the Account Reconciliation feature to perform a bank reconciliation. If you are using a Merchant Clearing or Cash Clearing account, we recommend completing the clearing reconciliations prior to completing the bank reconciliation.

IMPORTANT! You will need financial statements from your financial institutions to complete the reconciliation.

To prepare for a bank reconciliation, review the General Ledger account balance for your clearing accounts and verify any remaining balance in the account clears in the next accounting period. Once you have determined that all the balances are correct, you can perform an Account Reconciliation in LOU.

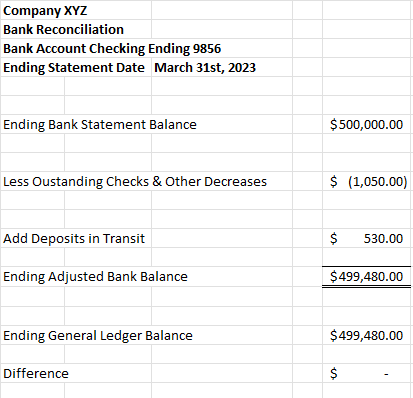

Once you’ve selected all cash in and out of your bank account general ledger account and have verified any uncleared transactions, you can prepare a bank reconciliation report to document. A simple format in Excel would look something like this:

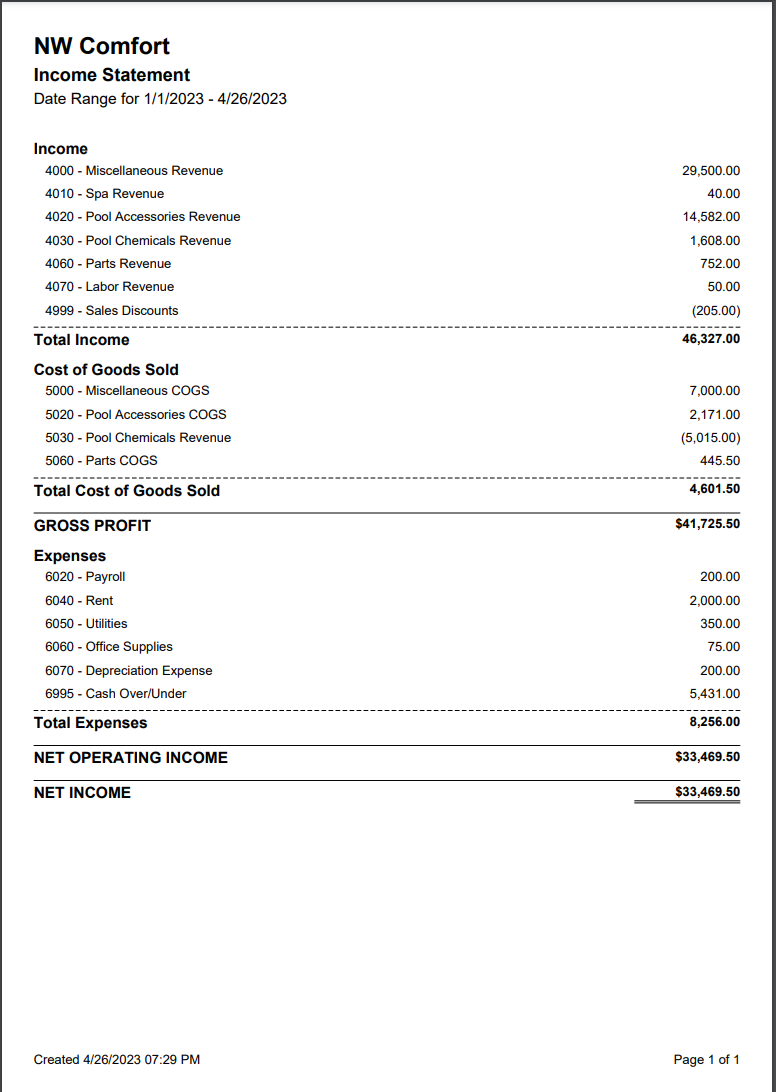

Generating Financial Statements

Once you’ve completed all the reconciliations, you can generate financial statements.

FASB and GAAP

Generally Accepted Accounting Principles (GAAP) are essentially the accepted standards and practices defined for businesses in the United States. These topics, as they are known, are maintained by the Financial Accounting and Standards Board (FASB) which is recognized by the US Securities and Exchange Commission "as the designated accounting standards setter" for public companies and businesses.

There are mandatory practices in GAAP that accounting professionals and businesses must follow. When you have questions regarding standards and practices, you can research the Topics released for GAAP by the FASB here or discuss with your Accounting professional.