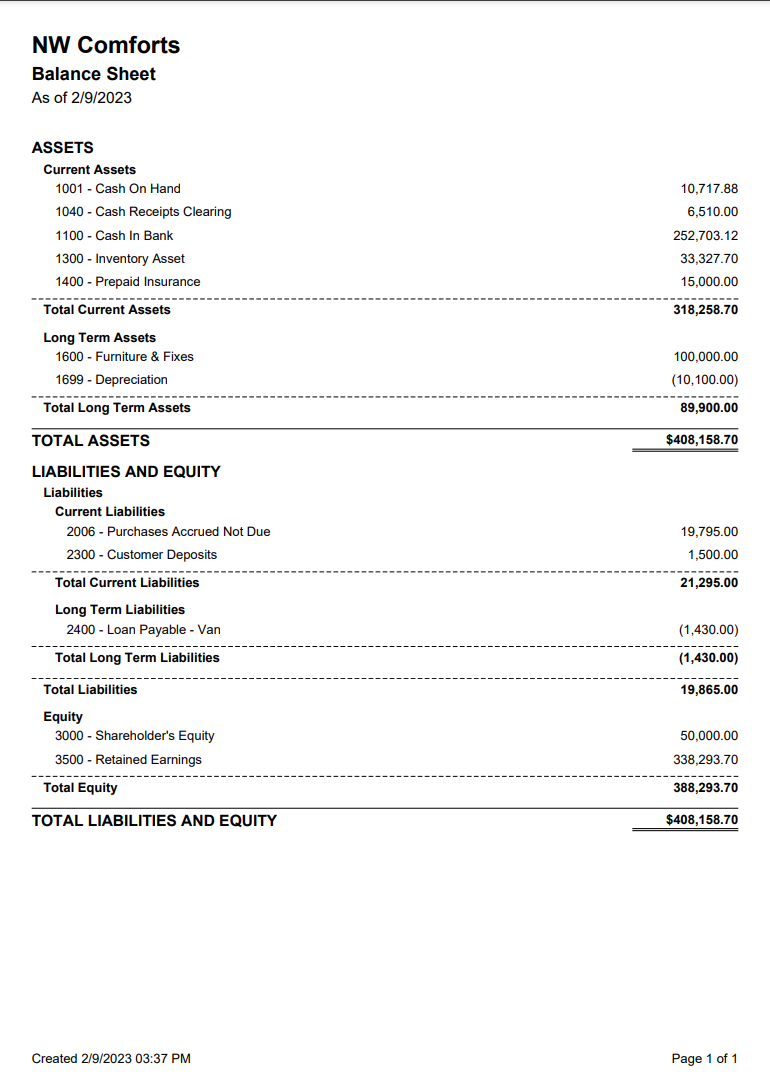

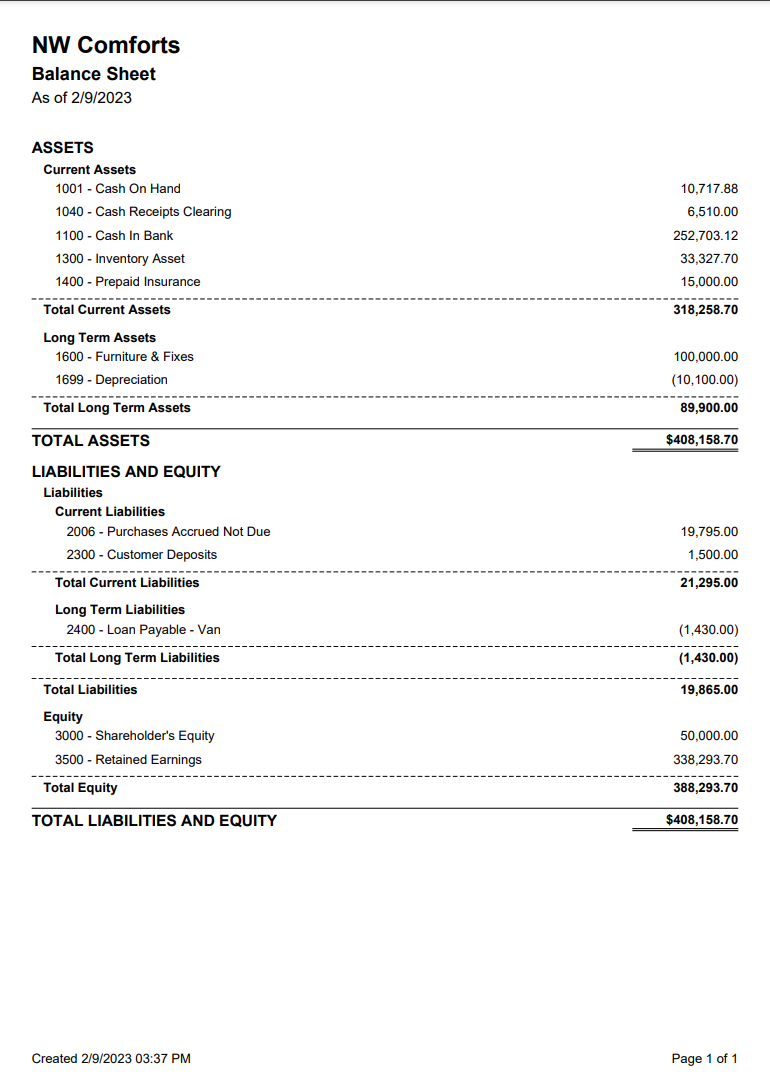

Create a Balance Sheet

Balance Sheets are a form of financial statement which report on the company’s assets, liabilities, and shareholder equity on a specific Date. Balance Sheets differ from Income Statements because they report on the financial health of the company for one date whereas Income Statements report on financial health over a period of time.

Assets, Liabilities, and Owner Equity will appear on the Balance Sheet. Revenue and Expenses will appear on the Income Statement.

Balance Sheets are most often used in conjunction with a Cash Flow Statement and an Income Statement. Curious how they compare? Check out this resource we found online.

Go to Accounting / Financials / Balance Sheet

A pop-up will open to allow you to set some parameters for the Balance Sheet.

Assets, Liabilities, and Owner Equity will appear on the Balance Sheet. Revenue and Expenses will appear on the Income Statement.

Balance Sheets are most often used in conjunction with a Cash Flow Statement and an Income Statement. Curious how they compare? Check out this resource we found online.

Helpful Accounting Equations

Assets = Liabilities + Owner Equity

Net Income = Revenue – Expenses

Net Income is a temporary Owner Equity Account called Retained Earnings in LOU. Owner Equity will increase if you have a profit and decrease if you have a loss.

Assets = Liabilities + Owner Equity

Net Income = Revenue – Expenses

Net Income is a temporary Owner Equity Account called Retained Earnings in LOU. Owner Equity will increase if you have a profit and decrease if you have a loss.

Go to Accounting / Financials / Balance Sheet

A pop-up will open to allow you to set some parameters for the Balance Sheet.

- Date Option Determine the Date for which you want to run the Balance Sheet and whether you want to compare to a Period.

- Display Options Determine whether you want to exclude Zero Balance Accounts, hide the Account Code, and exclude Cents.

- Output To Choose whether to export as a spreadsheet or print to .pdf. If you choose PDF, you can choose landscape to change the orientation of the report on the page.