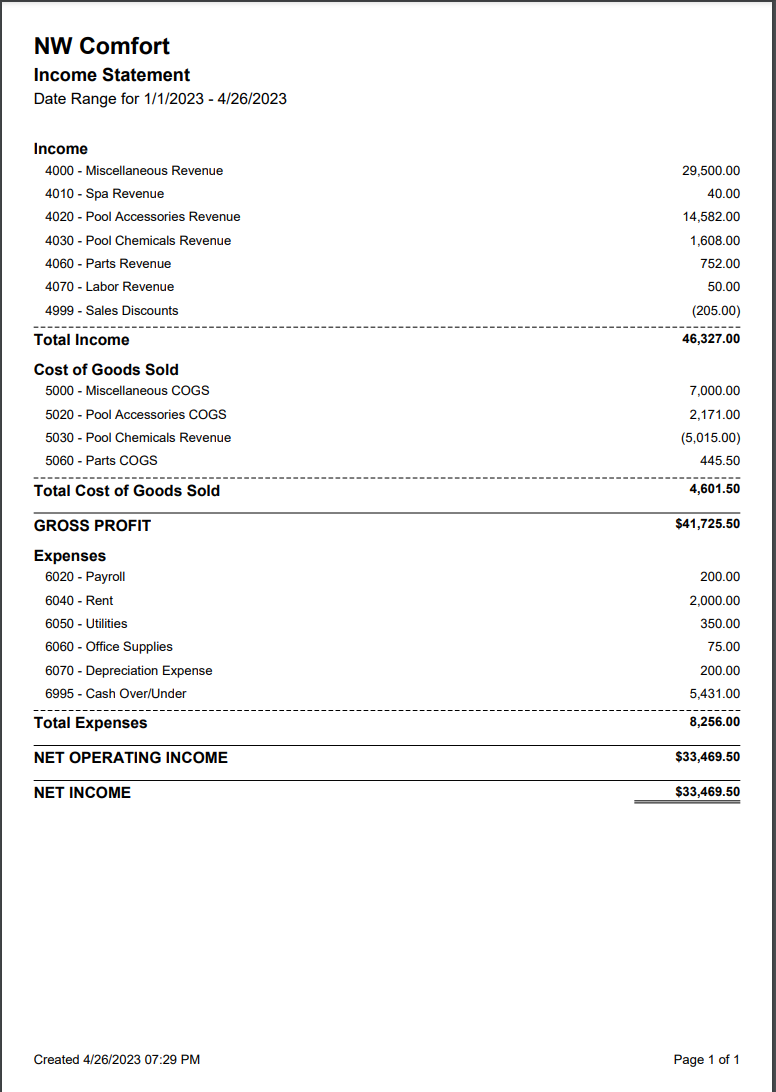

Income Statement

Income Statements are alternately known as a Profit and Loss Statement or an Earnings Statement. They show a business’ revenues, expenses, and profitability over a period of time. Income Statements are often used in conjunction with the Balance Sheet and Cash Flow Statement to report and track the health of a business. An Income Statement can demonstrate the profitability of the business to investors, creditors, and executives.

Revenue and Expenses will appear on the Income Statement. Assets, Liabilities, and Owner Equity will appear on the Balance Sheet.

Curious how Income Statements, Cash Flow Statement, and Balance Sheet work together? Check out this resource we found online!

A Print Preview will open and allow you to download to pdf or print to a printer.

Revenue and Expenses will appear on the Income Statement. Assets, Liabilities, and Owner Equity will appear on the Balance Sheet.

Curious how Income Statements, Cash Flow Statement, and Balance Sheet work together? Check out this resource we found online!

Helpful Accounting Equations

Assets = Liabilities + Owner Equity

Net Income = Revenue – Expenses

Net Income is a temporary Owner Equity Account called Retained Earnings in LOU. Owner Equity will increase if you have a profit and decrease if you have a loss.

Assets = Liabilities + Owner Equity

Net Income = Revenue – Expenses

Net Income is a temporary Owner Equity Account called Retained Earnings in LOU. Owner Equity will increase if you have a profit and decrease if you have a loss.

Retained Earnings

You must be live on LOU Accounting for one full fiscal year (365 days) before the Retained Earnings field will display data.

Go to Accounting / Financials / Income Statement

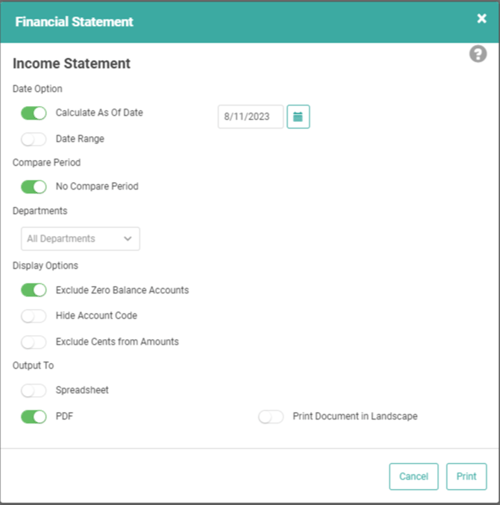

Determine the parameters by which you want to run the Income Statement:

- Date Option Choose Calculate As of Date or Date Range.

- Compare Period Toggle Off to Compare to a different Period of time.

- Departments Filter for a specific Department or All Departments

- Display Options Determine whether to Exclude Zero Balance Accounts, Hide Account Codes, and/or Exclude Cents from Amounts.

- Output To You can choose Spreadsheet or PDF, which also allows you to choose Landscape.

Click Print once you’re satisfied with the parameters.

A Print Preview will open and allow you to download to pdf or print to a printer.