Set Up Taxes

“In this world nothing can be said to be certain, except death and taxes.” The ol’ adage often attributed to Benjamin Franklin still rings true today. None of us like taxes, yet all of us must pay them.

One of your first tasks in LOU should be Tax Setup. Many other features throughout the system will rely on these Tax settings and you won't be able to properly set those features up without having the Tax Codes and Authorities set up first. These tax settings will help you track taxes related to your business.

There are three key parts to Tax Setup. Tax Authorities, Tax Codes, and Tax Nexus. To ensure your taxes are calculated correctly, you can test the Tax Code.

WAIT! Before you set up your Tax information, make sure you’ve got your GL Accounts squared away and your Tax Vendor Type and Vendors set up.

Looking for information on setting up your default Tax Code for PAX POS Stations? Head over to Departments.

Finished with your GL Account setup? GREAT! Let’s complete your Tax Setup!

Go to Product Setup / Accounting / Tax Setup

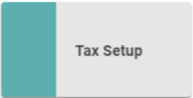

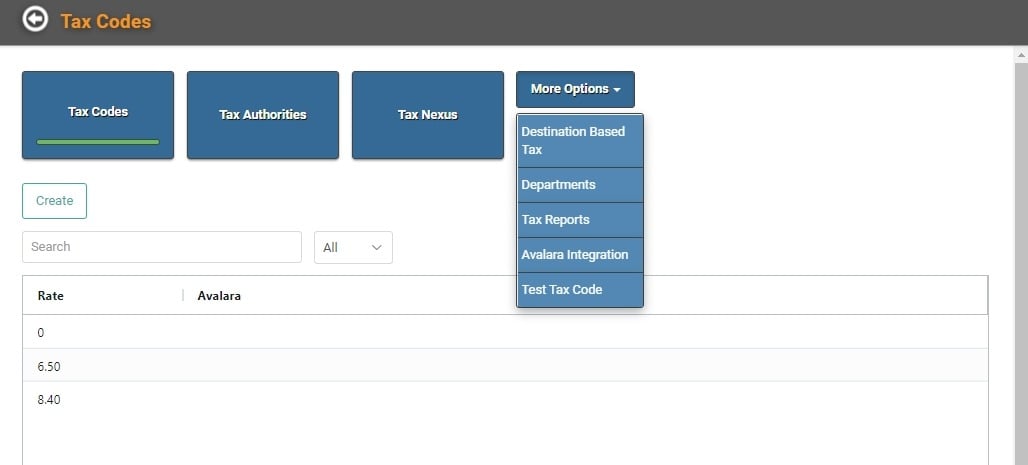

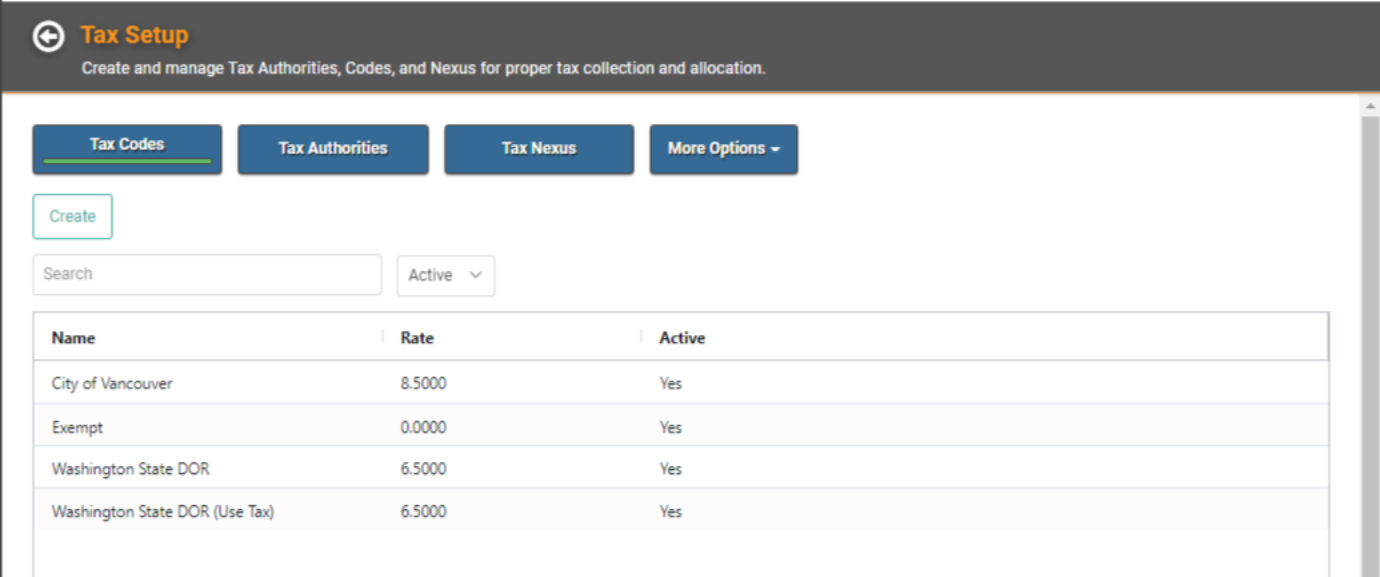

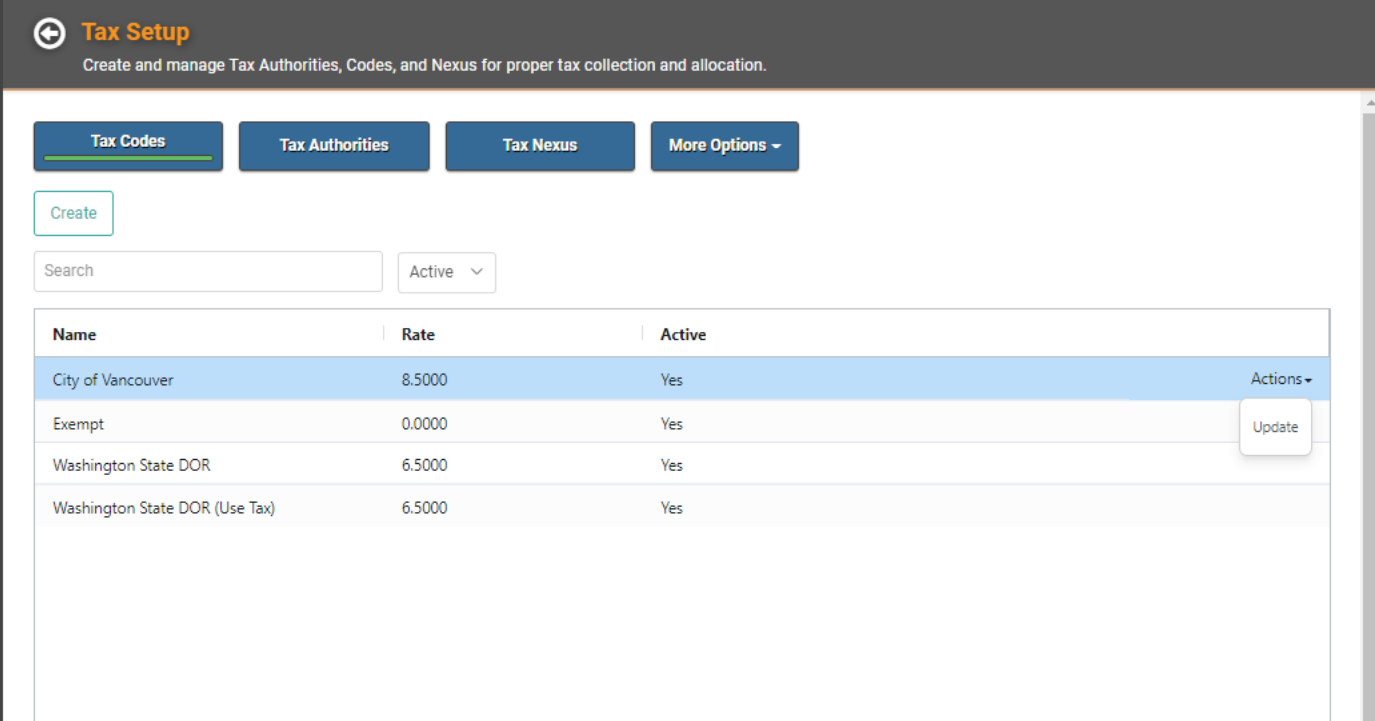

When you click the Tax Setup tile, you default to the Tax Codes page. You can click Tax Authorities, Tax Nexus, or More Options to access other pages within Tax Setup.

To set up taxes, you need to begin with your Tax Nexus and work your way left on the Tax Setup page, going to Tax Authorities next, and finishing with Tax Codes.

Tax Nexus

A Tax Nexus is your tax presence, or "nexus," in a taxing jurisdiction (state, country, etc.). The Nexus is the connection between your business and the taxing authority under which you must collect or pay taxes. LOU will automatically set up a default Tax Nexus based on your business address when you register. You can update the default and add new Nexus as needed.

IMPORTANT! A Default Tax Nexus is set up when you sign up for LOU, but you should double check that all the nexuses you need are set up correctly for your company.

Currently, LOU supports Tax Nexus and Authorities in four countries[1]:

- US - United States

- KY - Cayman Islands

- MX - Mexico

- CA – Canada

- To access Tax Nexus, click Tax Nexus

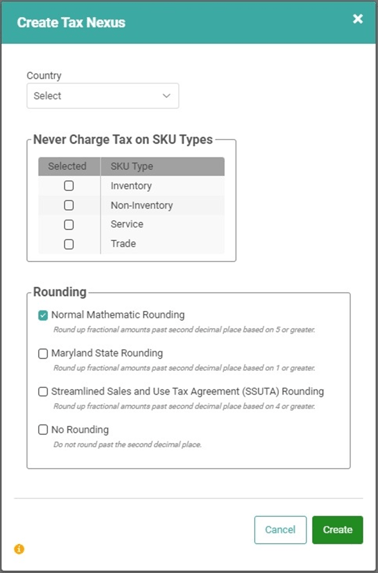

- To create a new Nexus, click Create

- Enter the necessary information

- Click Create

IMPORTANT! The Rounding method you choose must be the same as the rounding method for the state nexus. This will control how taxes are calculated and reported in LOU. If you are unsure, contact your state or tax professional for information.

- Normal Mathematic Rounding: rounds the second decimal position according to standard rounding rules. (Example: 1.447 becomes 1.45 while 1.444 becomes 1.44)

- Maryland State Rounding: rounds the second decimal position if a third decimal position exists. (Example: 1.441 becomes 1.45 while 1.447 also becomes 1.45)

- Streamlined Sales and Use Tax Agreement (SSUTA) Rounding: first, amount is carried to third decimal place and then rounded according to standard rounding rules. (Example: 1.446732 becomes 1.446 and rounded to 1.45)

- No Rounding: does not round at all and drops decimals after the second place. (Example: 1.447 becomes 1.44 while 1.44387 becomes 1.44)

Choosing an incorrect rounding method will cause under- or overstated taxes to be calculated and collected. To ensure you are collecting, reporting, and remitting the correct tax amount you must make sure you choose the rounding method utilized by your state.

You can repeat steps 2-4 to create every new Nexus you require.

REMEMBER! For your Tax Codes to work, they must be correctly associated with a Tax Authority AND Tax Nexus.

Delete a Tax Nexus

To Delete a Tax Nexus click the Actions link and select Delete.

CAUTION! There is no way to reverse a Delete. Use this feature with care.

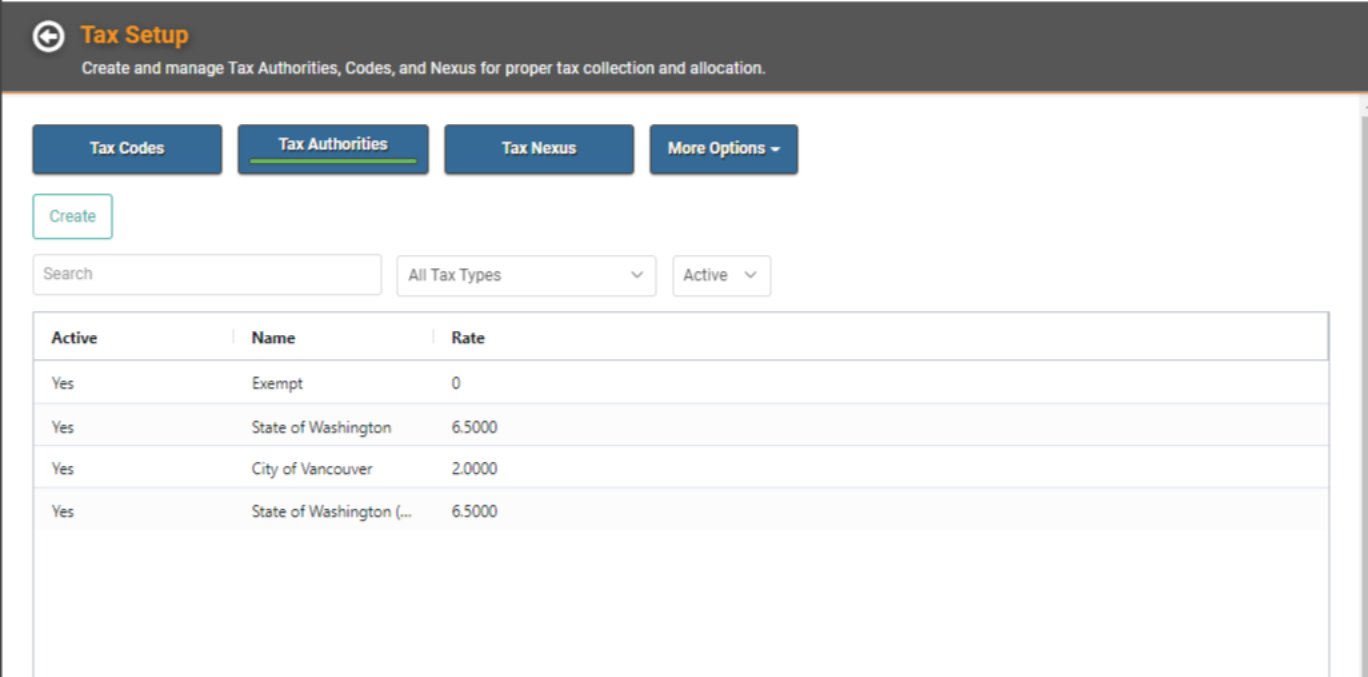

Tax Authorities

The next thing that needs to be set up is the Tax Authority(ies) to which you are liable. Tax authorities are the government or organizations responsible for collecting taxes.

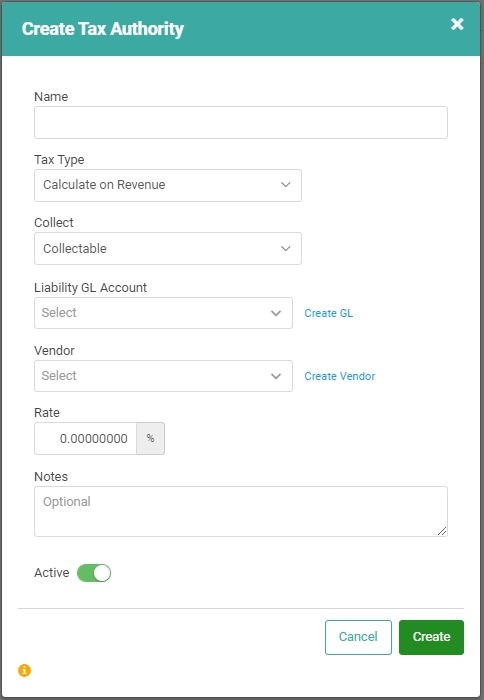

- Click

- Click

- Enter the necessary information. Heads up, you will need to have your tax authority information available.

- Click

when finished.

when finished.

Repeat these steps for every Tax Authority to which you are liable.

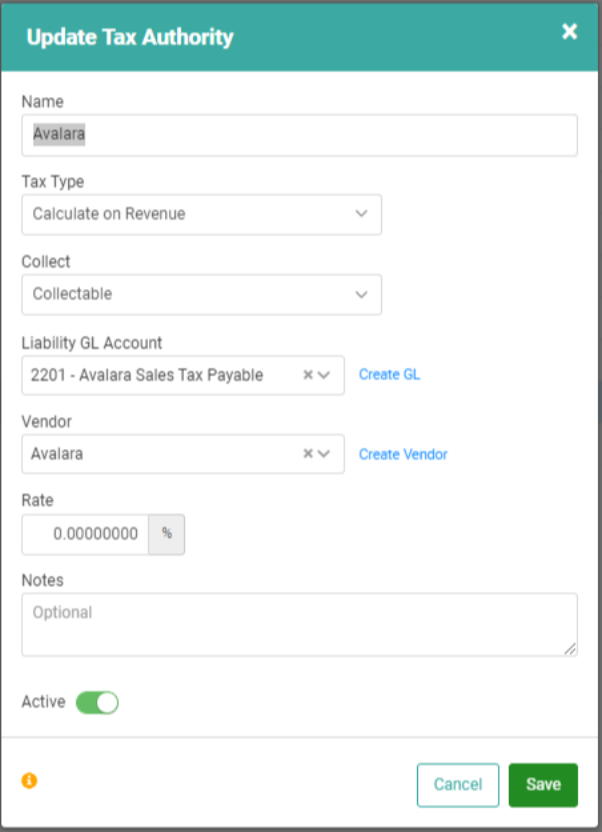

Avalara Integration

Are you using the Avalara integration? Avalara needs a generic Tax Authority against which LOU can record taxes. This Tax Authority will define the General Ledger Account to which all Avalara Tax calculations will be posted. The Tax Authority rate can be 0% as it will not be used. Multiple Tax Authorities are not needed. LOU needs one Tax Authority to help guide General Ledger postings and how to calculate taxes (using LOU or using Avalara). All Tax Authority level reporting will be handled in Avalara.

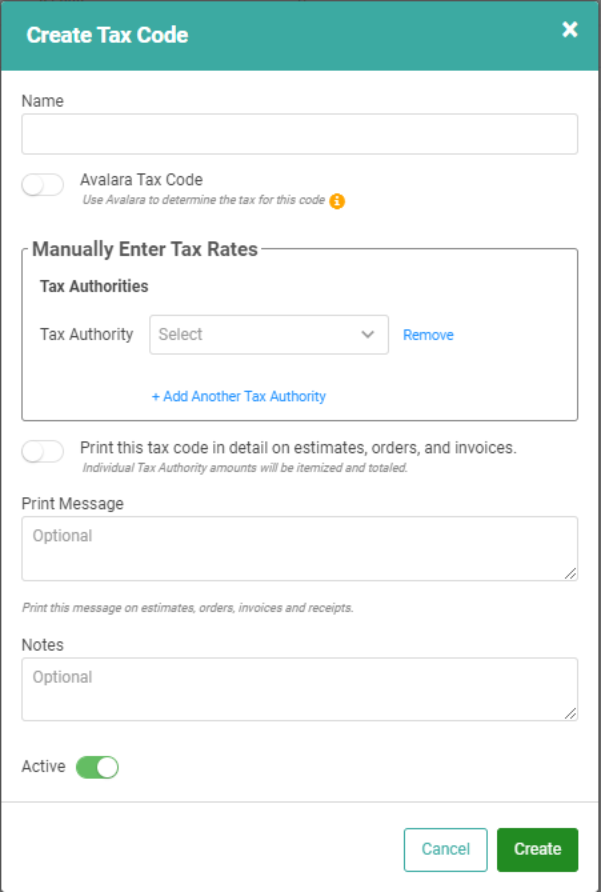

Tax Codes

After you finish setting up your Tax Authorities, it’s time to set up your Tax Codes. Tax Codes are the amounts/rules administered by the Tax Authorities. This is where you can define the Tax Rate and include messaging that appears on Retail POS receipts, Estimates, Orders, and Invoices.

- From the Tax Authorities page, click

- To create a new Tax Code, click

- Enter the necessary information

- Avalara Integration If you’re going to be using Avalara, and you want this Tax Code to be calculated by Avalara, make sure to toggle Avalara Tax Code on. Remember not all Tax Codes will use Avalara for calculations. Speak with your LOU Onboarding Specialist and Avalara Specialist if you’re unsure.

- IMPORTANT! The Print Message detail is where you can enter Tax Code detail that will display on documents, including PAX POS Station receipts. You can enter a message or simply type in the name of the Tax Code. On Documents and Receipts, this will display as “Tax Code: Print Message Text” where Print Message Text equals whatever you type in that field.

- Click

when finished.

when finished.

Repeat these steps for every Tax Code required.

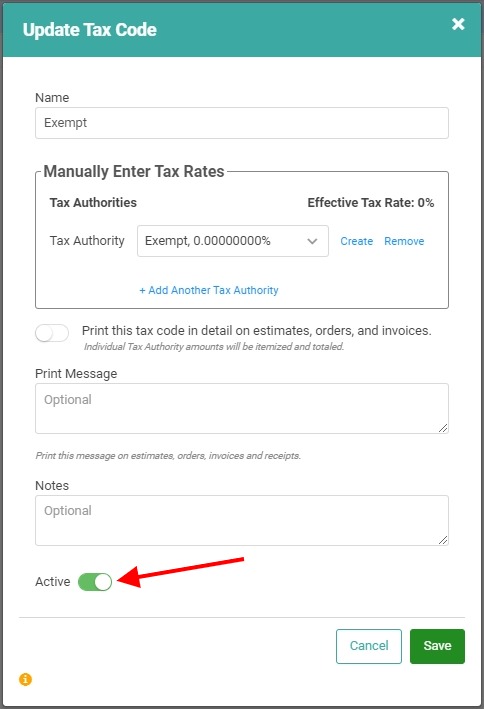

Delete Tax Authorities and Tax Codes

You cannot delete a Tax Authority or Tax Code. However, you can deactivate it by clicking on the Actions link next to the Authority or Tax Code, selecting Update, and toggling the Active button off.

Be sure to click  when you’re finished.

when you’re finished.

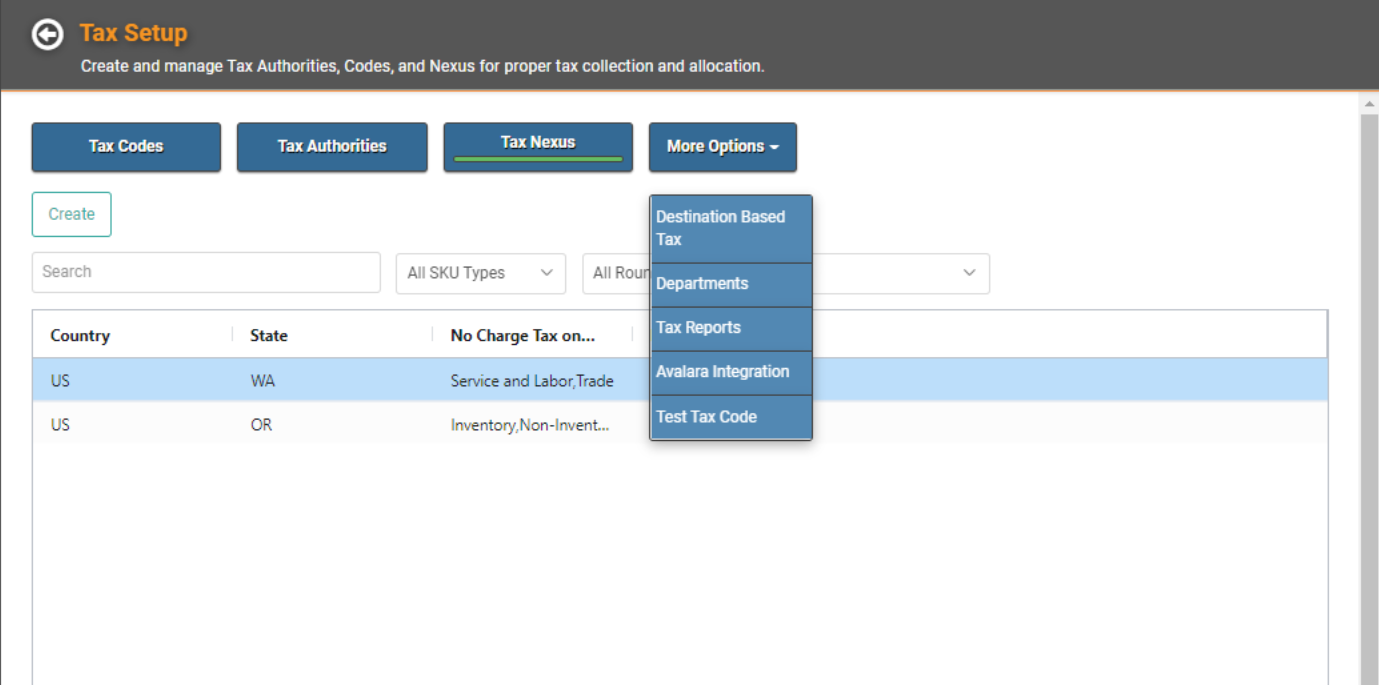

More Options

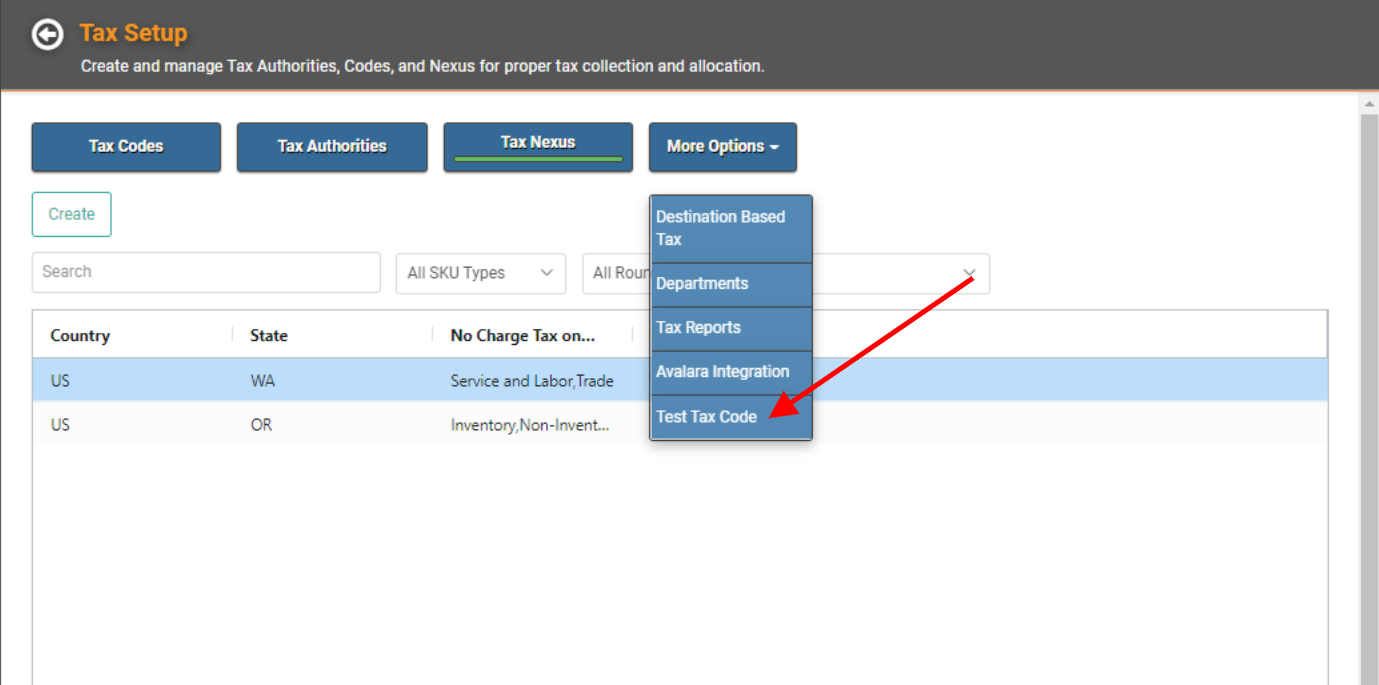

Under More Options, you can access several useful screens.

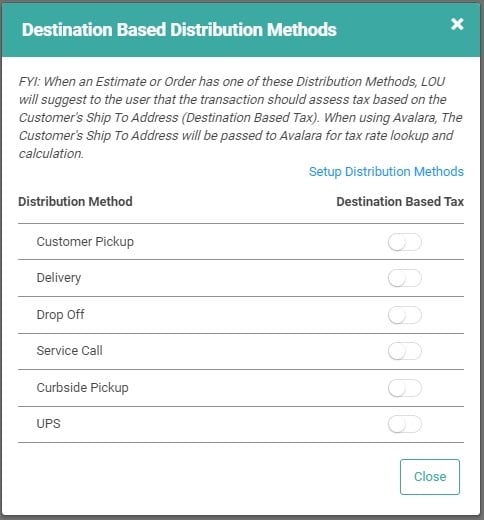

- Destination Based Tax: This is where you designate which Distribution Methods should calculate Tax based on the Ship To (Destination) Address. LOU will use this feature differently with the Avalara integration active. Without the Avalara integration, this feature serves as a reminder to manually change the Tax Code for Destination-Based Tax Calculations.

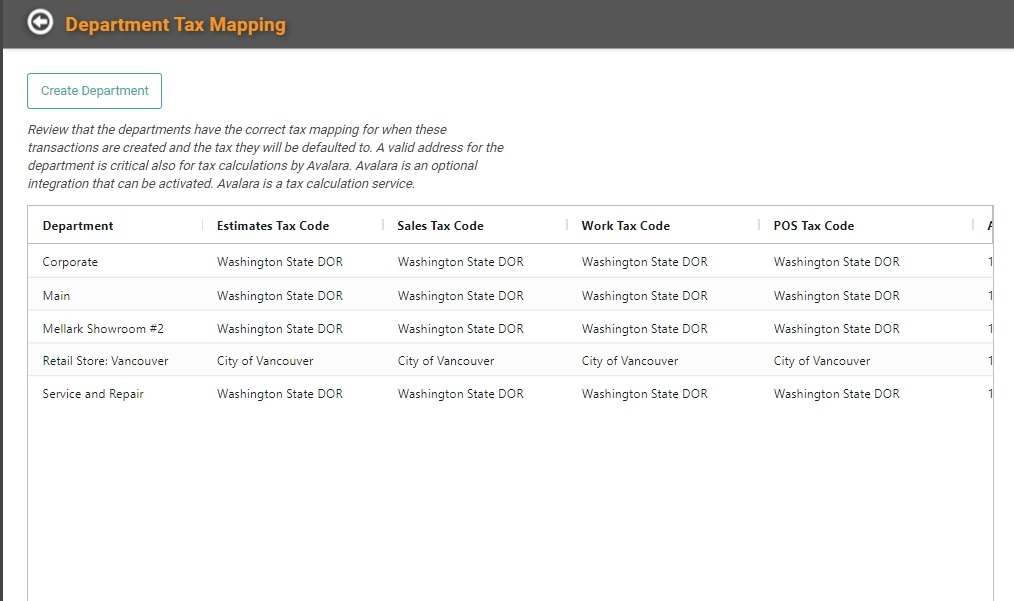

- Departments: Jump over to the Department Tax Mapping Screen to quickly view Department setups and add or change Tax Code information. You can even add additional Departments here.

IMPORTANT! The Create Department pop-up is exactly the same as the Create Department pop-up from Product Setup / Foundation / Departments.

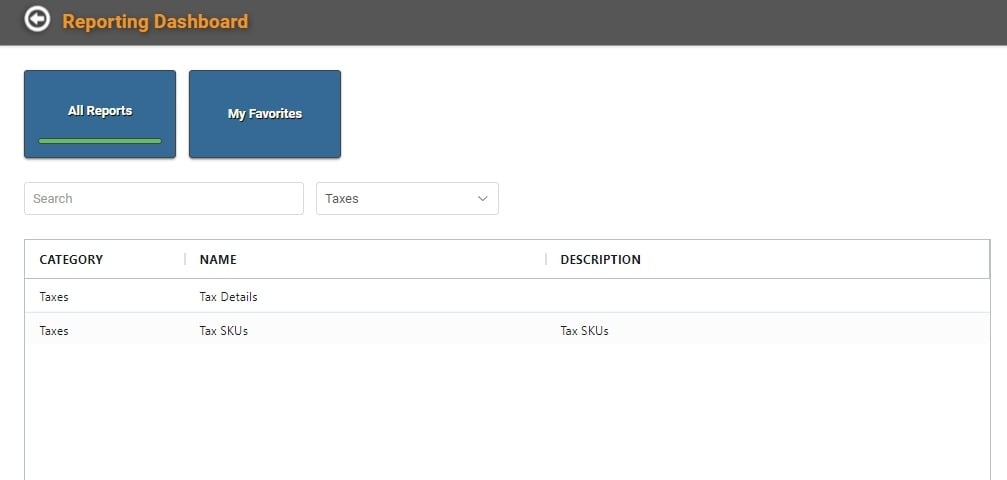

- Tax Reports: Head over to the Reports Page to pull relevant reports on Taxes.

- Avalara Integration: This allows you to quickly go to the Avalara Integration Configuration page.

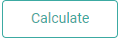

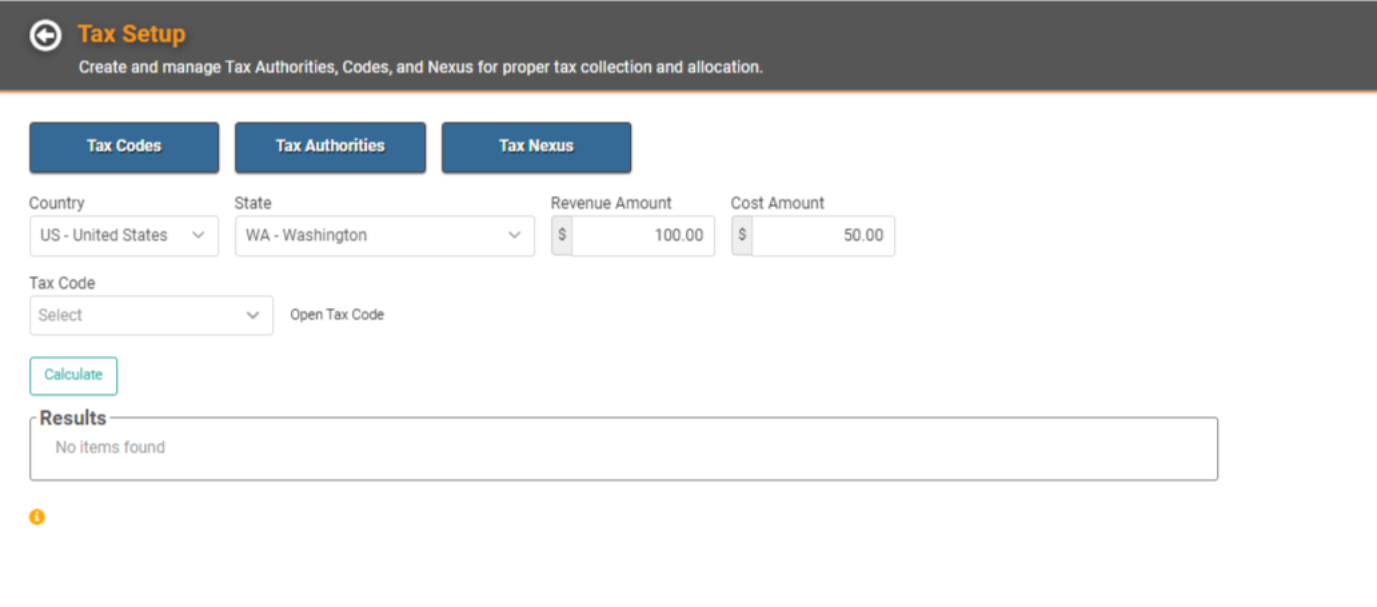

- Test Tax Code: This allows you to test the Code to ensure it’s calculating the way you expect.

- Click More Options and Select Test Tax Code

- Select the Country

- Select the State

- Enter a Revenue Amount and Cost Amount

- Select the Tax Code you want to test

- Click