Use Tax

What the heck is Use Tax? is defined as a tax on purchases made outside one’s state of residence for taxable items that will be used, stored, or consumed in one’s state of residence and on which no tax was collected in the state of purchase. If the purchase would be taxable if made in the purchaser’s state of residence, then use tax is due.[1]

Additionally, Use Tax can be understood as a tax on Cost that is applicable in some states when Inventory is used to permanently improve the Customer’s property; or when the Inventory is used by your company for internal purposes. Some states require businesses to report purchases for internal company use.

If you’re unsure whether you should be tracking and paying Use Tax, check with your local Tax Authority and/or Accounting Specialist.

IMPORTANT! LOU must have Tax Authorities and Tax Codes created for Use Tax to calculate correctly.

What’s that? You already set up your Tax Authorities and Codes and you just need to see how Use Tax works elsewhere? Click one of these links to jump ahead:

Several important things to remember about Use Tax:

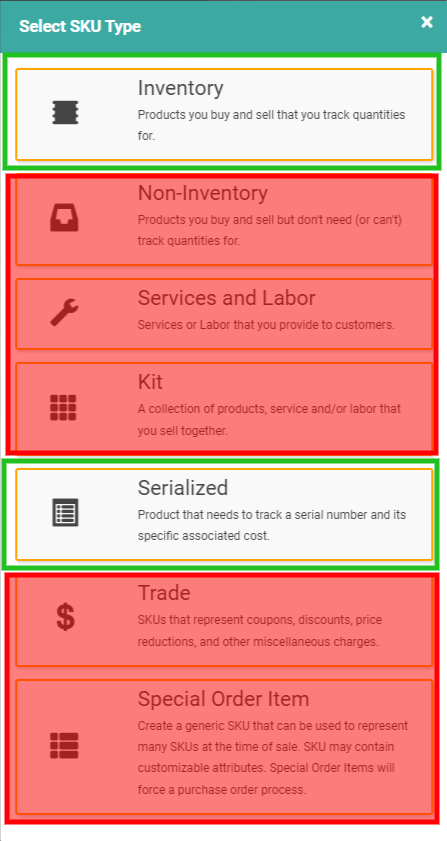

- Use Tax can only be calculated on Inventory and Serialized SKU Types.

- You cannot make a Calculate on Cost Tax Type Collectible.

- You cannot mix Revenue and Cost on a single Tax Code.

- Use Tax cannot apply to SKUs with a negative Quantity.

- You cannot Invoice Orders with Use Tax if the quantity is negative anywhere.

- Use Tax cannot be used on LOU Retail POS transactions.

- Use Tax is not part of the Avalara integration. Use Tax Invoices will not be included in the nightly batch process sent to Avalara.

Go to Setup / Accounting / Tax Setup

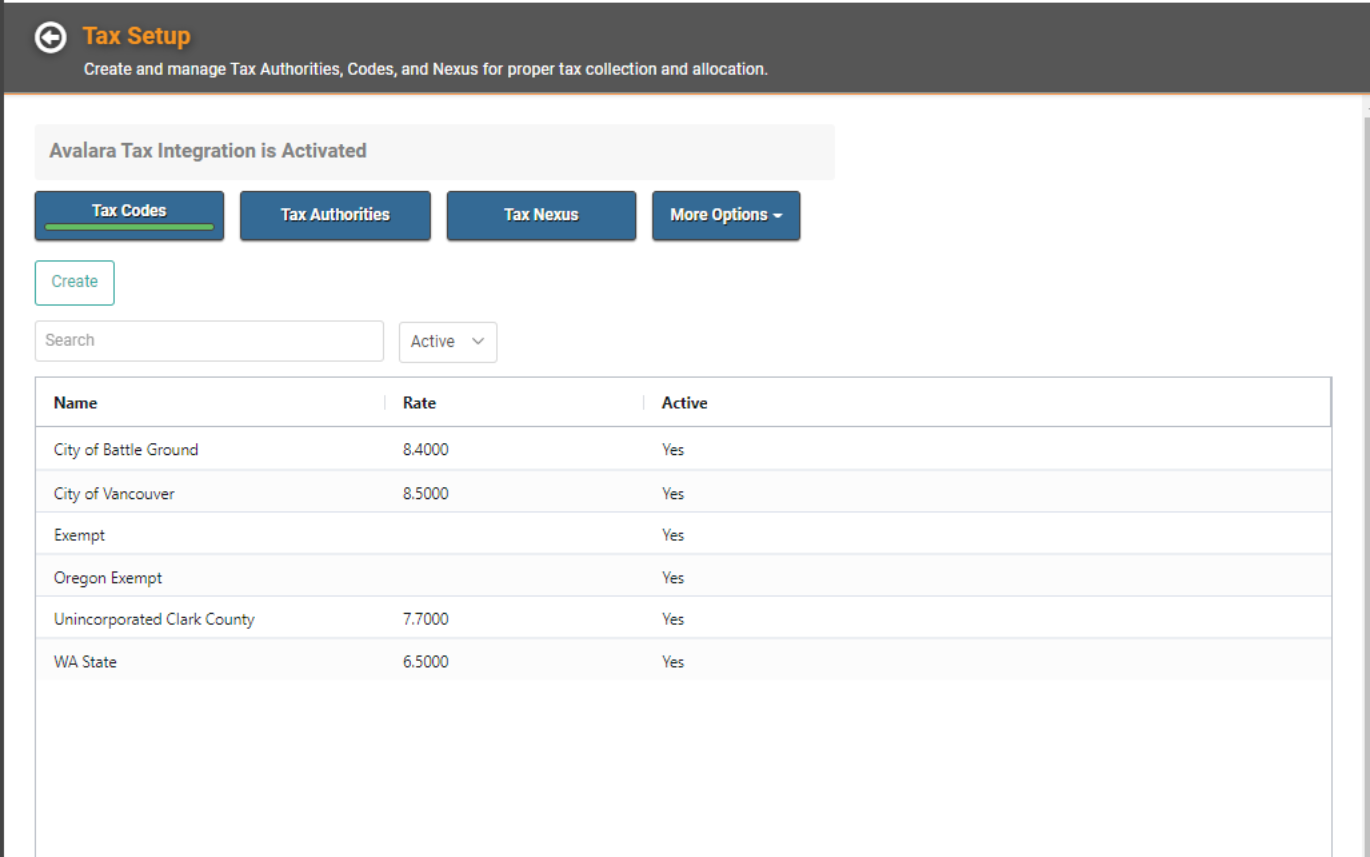

Tax Authorities

The first step is always to create the Tax Authority, so click on Tax Authorities. From that page, click Create.

- Give your Tax Authority a name.

- Select the Tax Type. For Use Tax, that should be Calculate on Cost. When you do that, LOU will automatically change Collect to Not Collectable since Use Tax is not passed along to the consumer.

- It will also expose a Not Collectable Tax Expense box allowing you to choose the Tax Expense GL Account to be used.

- Select the Liability GL Account.

- Select the Tax Vendor.

- Enter the Tax Rate.

- Finally, enter optional Notes.

Once you’re satisfied, click Create.

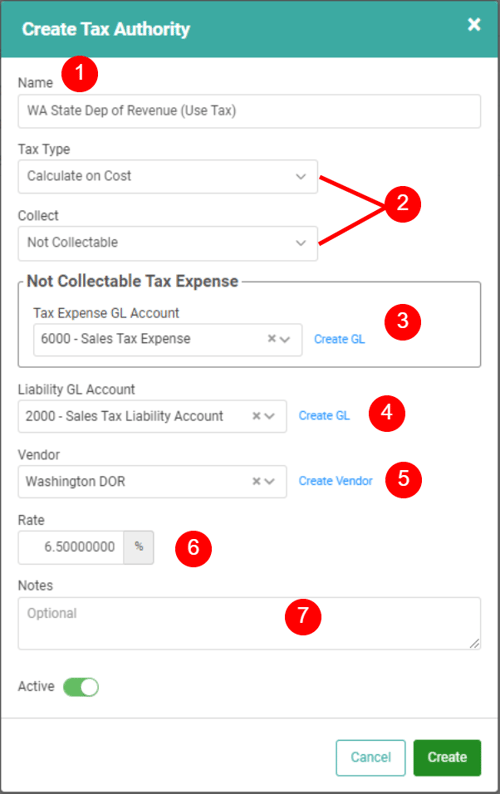

Tax Codes

Creating the Tax Codes is the same as Sales Tax. Head to How to Set Up Taxes if you need refresher.

REMEMBER! You can add multiple Use Tax Authorities to a Use Tax Code, but you cannot combine Revenue Tax Authorities with Cost/Use Tax Authorities.

Orders and Estimates

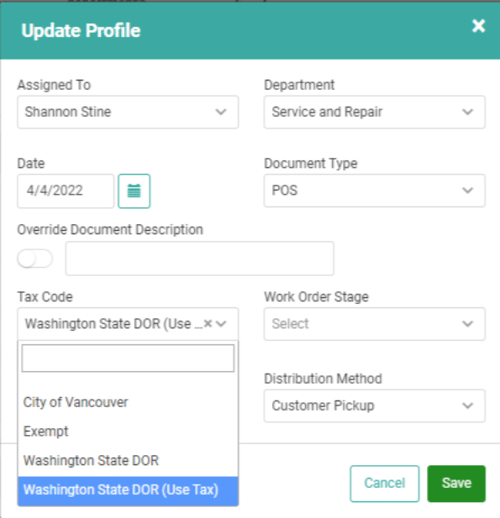

Create an Estimate or Order and click Update on the Profile box.

Update the Tax Code dropdown and click Save. The Estimate or Order will now apply to all Inventory and Serialized SKUs added to the Document.

BEST PRACTICE! Use Tax and Tax Collectible SKUs should never be mixed. Create one Order for the Use Tax SKUs and a separate Order for the Tax Collectible SKUs.

SKU Types

Use Tax can only apply to Inventory and Serialized SKU Types.

IMPORTANT! While Use Tax does not apply to the Special Order Item SKU Type, this SKU Type is unique because it’s used to facilitate ordering an item that will become a Serialized SKU. When you add an SOI to an Estimate or Sales/Work Order, you create a PO for that item. Once you receive the item into inventory, a Serialized SKU becomes associated with the item instead of the SOI SKU used on the PO. This Serialized SKU replaces the SOI SKU on the Estimate or Sales/Work Order and can have Use Tax calculated on it.

Estimate Tax Link

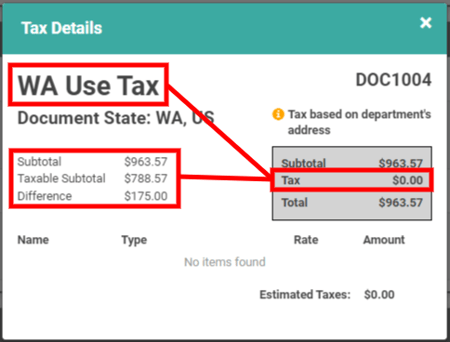

Since Use Tax is not directly passed on to your Customers (not collectible), the Tax amount will show as $0 when you click Estimate Tax on an Estimate or Order. The Tax Details window will display the Subtotal, Taxable Subtotal, and the Difference. The Taxable Subtotal will represent the Subtotal for all SKUs that are classified as Taxable on the SKU Profile even if no Tax will be collected because of Use Tax.

CAUTION! You cannot mix Use and Revenue Tax Codes on Estimates and Orders. We strongly advise against combining SKUs on a single Estimate or Order. LOU will not calculate Sales Tax on an Order with Use Tax selected.

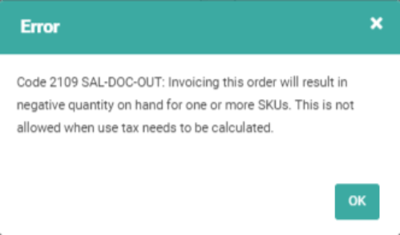

Negative SKU Quantities at Invoicing

When Use Tax is being calculated, you are not permitted to Invoice an Order if there is a negative QOH on any of the SKUs. If you attempt to Invoice the Order, you’ll receive a message letting you know this is not allowed.

All SKUs on the Order should be available in Inventory with a QOH greater than zero before you Invoice the Order.

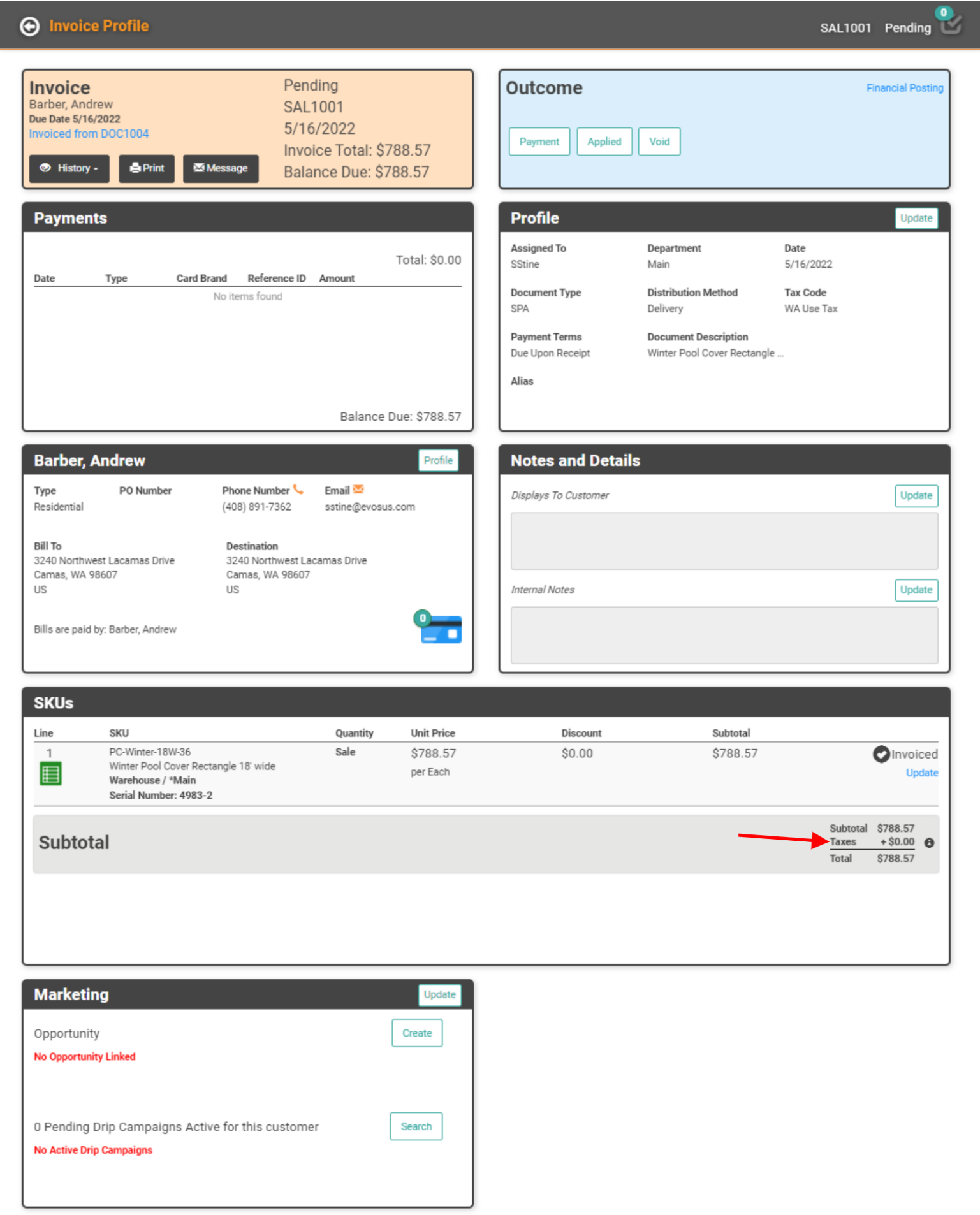

Use Tax on Invoices

When you Invoice an Order that has Use Tax, the Total will display only the principal amount with Taxes calculated as $0 because they cannot be passed on to your Customers. The Customer may be responsible for the principal, but you are responsible for the Use Tax.

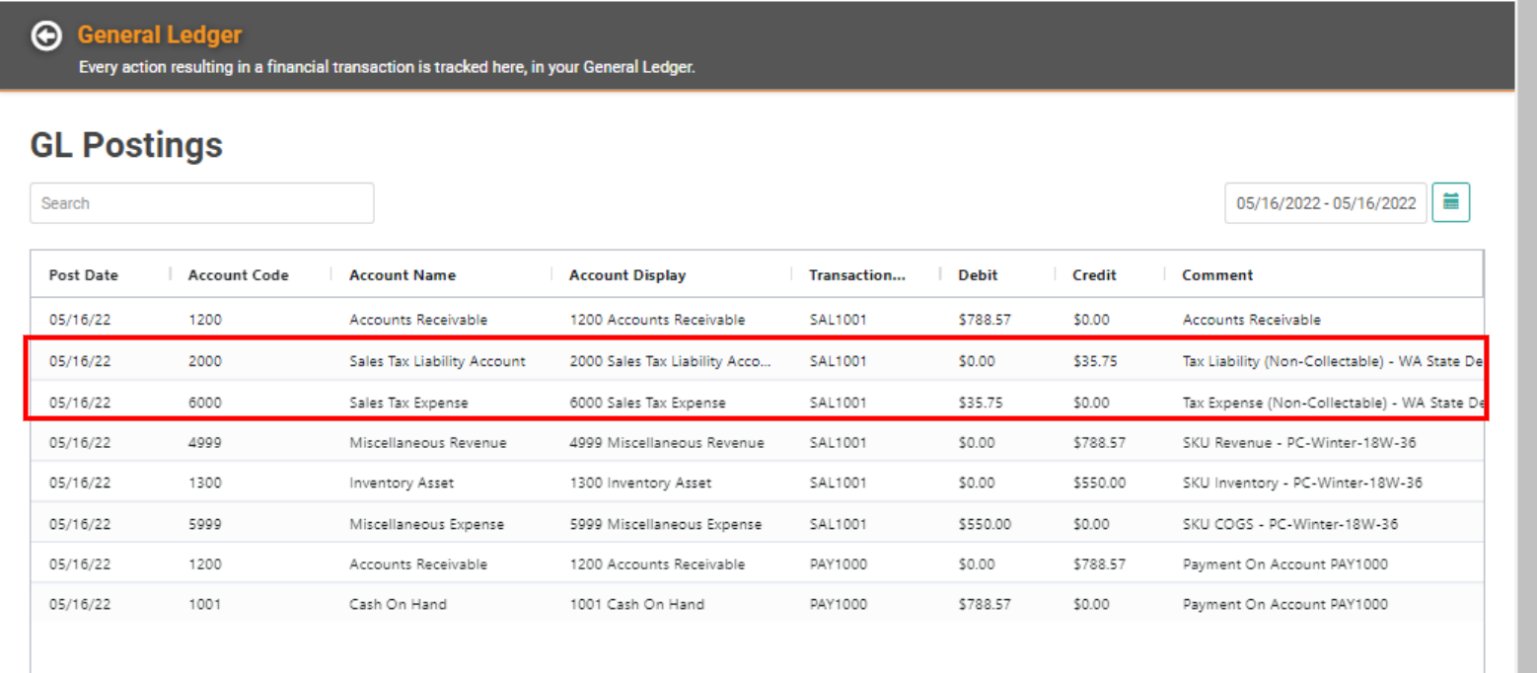

General Ledger Postings

Use Tax posts on the General Ledger as a Credit to the Tax Liability Account and as a Debit to the Tax Expense Account, both of which you define in the Tax Authority when you create it. Once an Order has been Invoiced and Payment received, the two Tax line items will be written.

Reports for Use Tax

Your business will be responsible for reporting and paying the Use Tax. Head to LOUs Reports and run the Tax Details Report for the Date Range you need and select the By Tax Type Report Template from the Dropdown.

This Tax Details By Tax Type report will display several pieces of information, including Tax Code, Tax Authority, Authority Rate, Taxable Invoice Subtotal, Non-taxable Subtotal, Quarter, Invoice Year, Demographics information, and more!

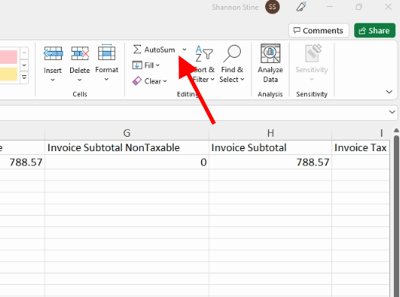

Get Report Totals by performing the following:

- Export the report to Excel.

- Highlight just the data in the Tax Authority Amount Column (do not highlight the Column header).

- Click AutoSum

You should see a Sum Total at the bottom of the Column. Repeat these steps for any Amount fields you want to Sum.