Get Started with Avalara

Getting started with Avalara is easy! Whether you’re already live on LOU or still in onboarding you’ll need to have an active account with Avalara before you can activate and use the integration.

Want to know more about Avalara before you sign up? Head over to Avalara for more information.

Check out How to Set Up the Avalara Integration to find out how to activate the Avalara integration.

Contacting Avalara

We’re happy to get a conversation started between you and an Avalara account specialist.

Onboarding

Just let your Account Manager know you’d like to get started with Avalara.

We’ll make introductions between you and Avalara! From there, the Avalara Specialist and their team will work with you to finalize your annual contract, set an onboarding agenda, and begin setting up your Avalara account.

You’ll be onboarding in Avalara while continuing onboarding with LOU. Don’t worry! Both your Avalara Specialist and your Onboarding Specialist will be with you every step of the way!

Live on LOU

Let a rockstar in Support know you’d like to get started with Avalara.

We’ll make introductions between you and Avalara! From there, the Avalara Specialist and their team will work with you to finalize your annual contract, set an onboarding agenda, and begin setting up your Avalara account.

You’ll be onboarding in Avalara while continuing to use LOU with your current settings. LOU Support will work with you along the way to ensure that any additional settings that need to be configured to begin using Avalara are set up and ready by the time your account with Avalara is live.

Setup in LOU

If you’re in Onboarding still, there will be a little bit of overlap in your onboarding processes with Avalara and LOU. If you’re already live in LOU, there are some things you’ll need to change when you activate the integration. However, you may have some settings you never configured in LOU that will need to be configured too.

SKU Categories

Avalara System Tax Codes will need to map directly with LOU SKU Categories.

For both Onboarding and Live clients, we recommend spending the time to get your SKU Categories right for your business. Be intentional and thoughtful in creating your SKU Category structure. When you start choosing the Avalara System Tax Codes to use, having this SKU Category structure already in place will help guide your decisions.

REMEMBER! Neither your Avalara Specialist nor your LOU Onboarding Specialist/LOU Support Specialist can create the SKU Category structure or choose the Avalara System Tax Codes for you. You know your business better than we do! But we’re totally here to help. Whether it’s Avalara or LOU, you can be confident we’re here to talk through the structure with you and guide you along the way.

Resources:

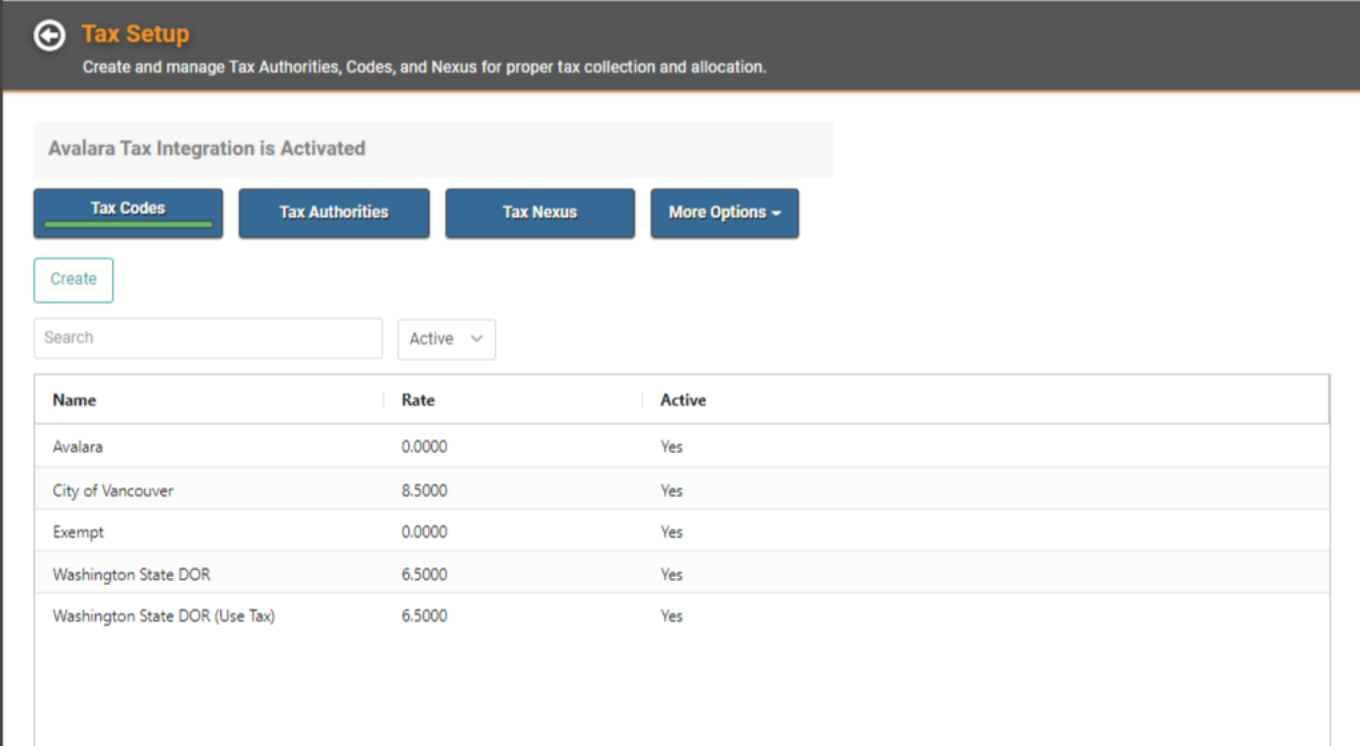

LOU Tax Authorities and Codes

You will need to create Tax Authorities and Codes in LOU. Some of these will use Avalara to calculate the tax and others will not. You will need to create a Tax Authority and Code for Avalara as well.

Before you activate the Avalara integration, make sure you’ve created all the Tax Authorities and Codes you’ll need in addition to the Avalara Tax Authority/Code.

REMEMBER! Before you can create Tax Authorities, you need to create your Tax Vendor Type and Tax Vendors. You will also need to make sure you have your Chart of Accounts squared away.

IMPORTANT! Don’t forget your Tax Nexuses.

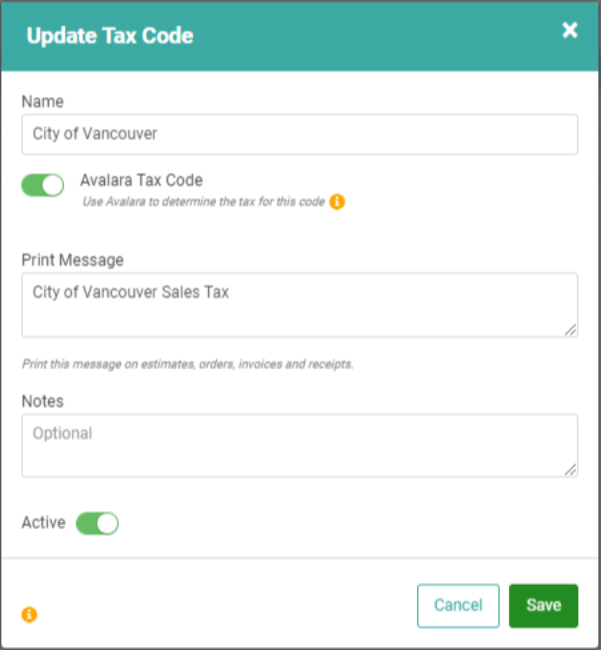

While you’re setting up your Tax Codes, consider which Tax Codes will use Avalara to calculate the tax. You can toggle the Avalara Tax Code on.

TIP! The Avalara Tax Code toggle will override manually entered Tax Rates as long as the toggle is on and the Avalara integration is active. If you’re already live on LOU, you can go in and update the Tax Codes on which you want Avalara to calculate taxes any time prior to turning on the integration. Just remember that as soon as the integration is active, those Tax Codes will be calculated by Avalara, not your manually entered rates.

Resources:

- How to Set Up Taxes

- How to Create Vendor Types

- How to Create Vendors

- How to Create a Chart of Accounts

- How to Create a Chart of Account Defaults

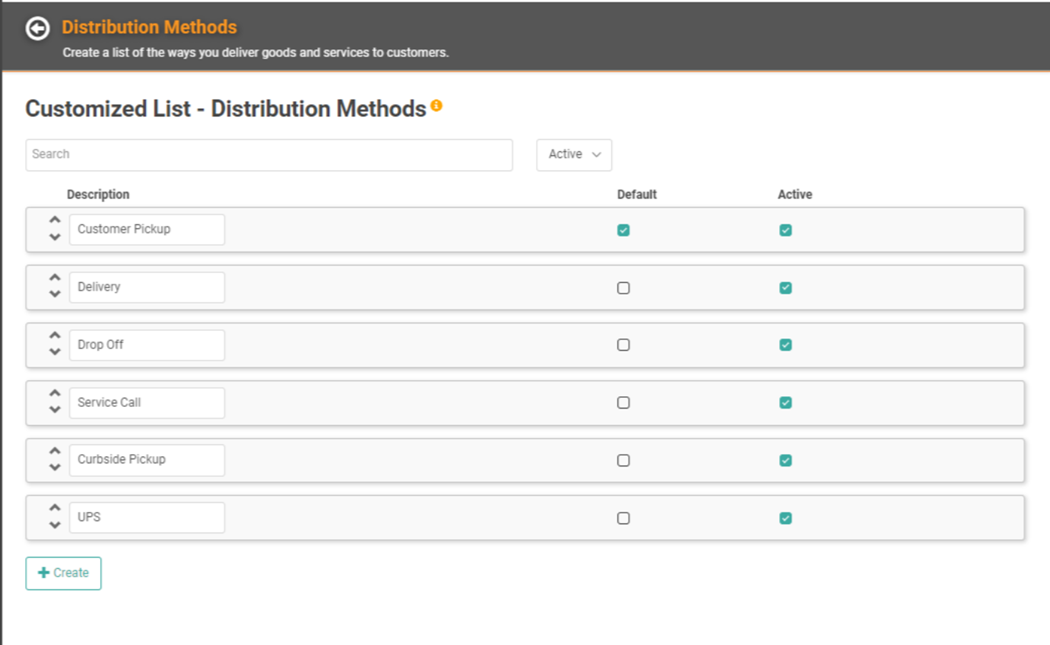

Distribution Methods

You can define which Distribution Methods should calculate taxes based on destination. This can be determined through Tax Setup or through the Avalara integration configuration page. You will need to have your Distribution Methods set up first!

Resources:

Departments

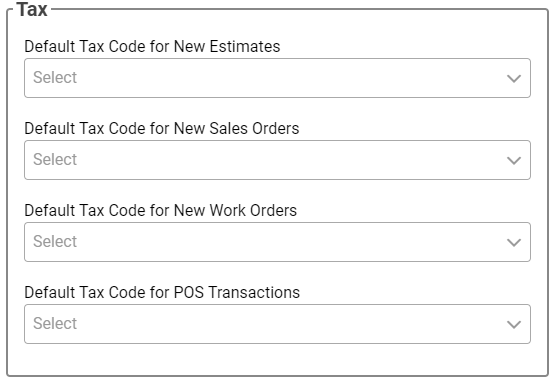

When you set up your Departments you must define default Tax Codes for Estimates, Sales Orders, Work Orders, and POS Transactions.

For each of your Departments, you will want to consider whether the Default Tax Codes for each transaction type will be Tax Codes that use Avalara to calculate tax.

REMEMBER! For POS Transactions, Avalara will not calculate tax.

Resources: