Access the Cash Flow Statement

A Cash Flow Statement helps determine your business’ performance. Three types of cash flow are represented on the statement to track the liquidity and solvency of your business.

Looking for more information about Cash Flow Statements and how they're used in Accounting Practices? Check out this resource we found online.

WAIT! Before you can run a Cash Flow Statement, you need to configure the Cash Flow Statement .

Go to Accounting / Financials / Cash Flow Statement

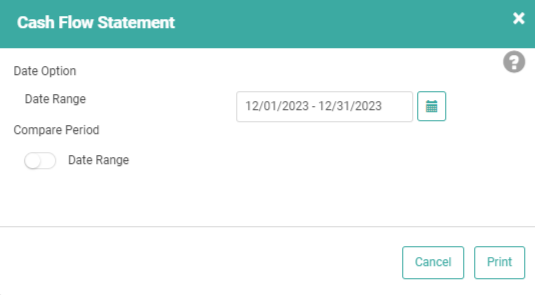

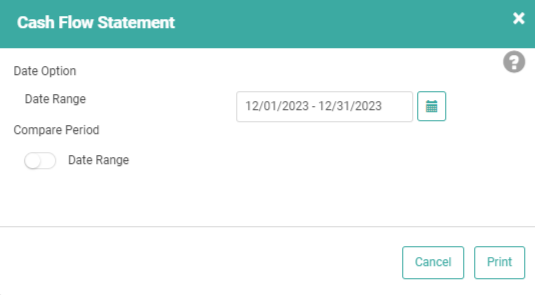

A modal will pop up when you click the tile, allowing you to determine the Date Range for which you want to run the statement and whether you want to compare it to a different statement.

Once you’ve selected the Dates, click Print. A Print Preview will open in a new tab.

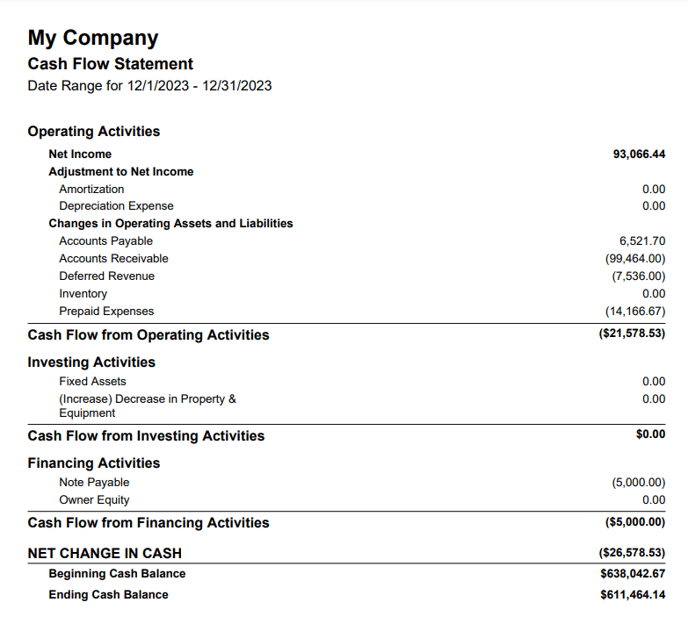

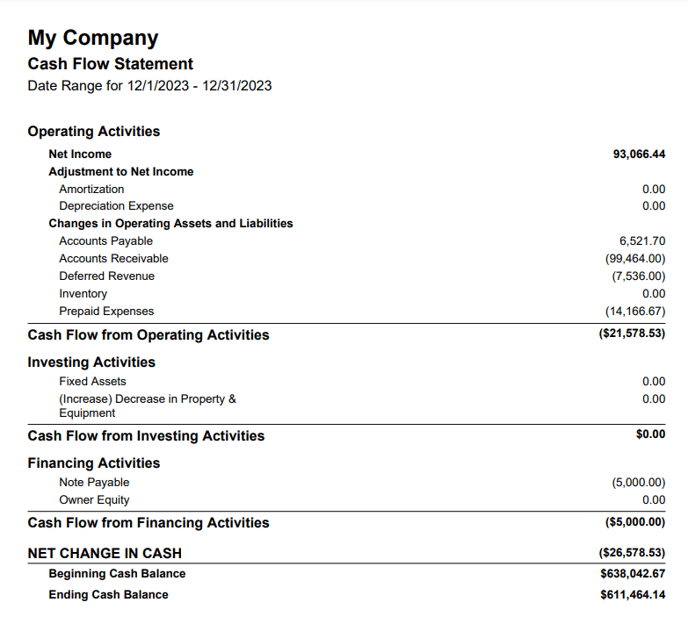

The Statement will be laid out according to how you configured the statement with each of your Categories listed in their Sort Order. The statement will tell you what your Cash Balance was at the beginning of this Statement Period and what the Cash Balance was at the end of this Statement Period.

It will also tell you if there is an imbalance between the Cash Balance and the GL ending Cash Balance.

- Operating Activities

- Investing Activities

- Financing Activities

Looking for more information about Cash Flow Statements and how they're used in Accounting Practices? Check out this resource we found online.

WAIT! Before you can run a Cash Flow Statement, you need to configure the Cash Flow Statement .

Go to Accounting / Financials / Cash Flow Statement

A modal will pop up when you click the tile, allowing you to determine the Date Range for which you want to run the statement and whether you want to compare it to a different statement.

Once you’ve selected the Dates, click Print. A Print Preview will open in a new tab.

The Statement will be laid out according to how you configured the statement with each of your Categories listed in their Sort Order. The statement will tell you what your Cash Balance was at the beginning of this Statement Period and what the Cash Balance was at the end of this Statement Period.

It will also tell you if there is an imbalance between the Cash Balance and the GL ending Cash Balance.