How Transactions Post to the General Ledger

IMPORTANT! Not all transactions impact your LOU General Ledger. Here is a list of transactions with no GL impact:

- All Beginning Balance Activity during Onboarding

- Creating a new Estimate

- Creating a new Sales or Work Order

- Creating Recurring Orders

- Creating a new Vendor Purchase Order

- Placing a Vendor Purchase Order On Order

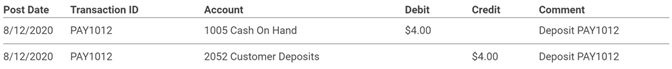

Taking a Deposit on an Open Order

A cash deposit of $4.00 was taken on an Order. The deposit total will remain in the Customer Deposits liability account until the Order is invoiced in LOU.

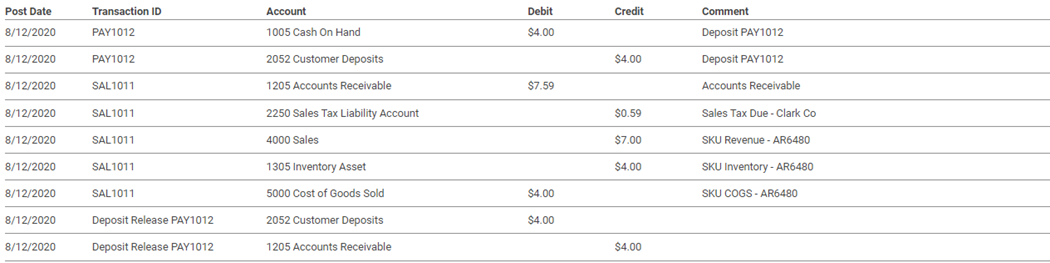

Invoicing an Order with a Deposit on File

Revenue is recognized when you invoice an Order. Invoicing an Order is also when LOU will adjust your inventory quantities to reflect the sale is complete. In the GL below we can see a few things happening:

- The $4.00 deposit on the order was removed from the Customer Deposit Liability account and posted to Accounts Receivable.

- The tax amount, $0.59 posted to the Sales Tax Liability Account

- Total sales revenue of $7.00 posted to our GL 4000 Sales

- Since inventory was reduced we recognized the decrease in inventory assets and recognized the cost of the inventory, $4.00 to Cost of Goods Sold

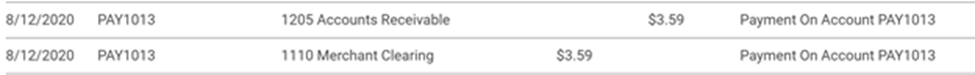

Taking a Payment on an Invoice

This payment was taken as a card payment. Credit Card Payments impact the Merchant Clearing general ledger account rather than the Cash on Hand General Ledger account. You will clear your Merchant Clearing account in your accounting software outside of LOU, such as QuickBooks Online.

Taking an Unapplied Payment

An Unapplied Payment is a Payment that was not associated with an open Order or Invoice. Unapplied Payments impact the General Ledger the same way as a Payment applied to an Invoice or Order.

Receiving Inventory on a Purchase Order

When you receive inventory on a Vendor PO, the cost of the items received will be posted to a liability account called Purchases Accrued Not Due (PAND). This liability account will retain the cost of your inventory received until you associate the received inventory to an AP invoice. This association, which ultimately clears the PAND account, will be done in your separate accounting system, such as QuickBooks Online.

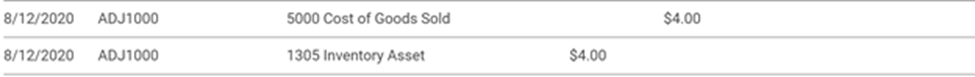

Creating a Stock Adjustment

For this stock adjustment, we increased an item quantity on hand. The new inventory quantity increased the Inventory Asset account.

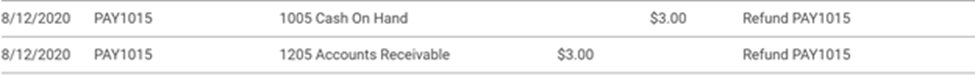

Creating a Refund Payment

This refund was done with cash which is why the Cash on Hand GL account was impacted.

When you refund a transaction on a different day from the original transaction, it will post to the Cash On Hand GL account on the day you process the Refund, not the original date of the transaction.

Voiding an Invoice

Voiding an invoice will reverse all the original General Ledger activity created when invoicing the Order. You can see the [Reversal] on the right-hand side of the screenshot. It’s important to note that voiding an invoice will simply reopen the Sales or Work Order for additional action to be taken.

The reversal will post to the same date as the original Invoice even if you are voiding an Invoice from another day. If you have already exported this date from LOU and imported it into QBO, you will not be able to re-import updated data into QBO. You will have to manually change the information in QBO. In LOU, you can delete and recreate the batch, but it cannot be re-imported into QBO, per QBO’s limitations.

REMEMBER! You can only Void an Invoice during the same Accounting Period. To process a refund on an Invoice in a previous Accounting Period, you will need to create a Return Order and process the refund through a Return Invoice. For LOU Retail POS, you would simply post a Return Transaction through the LOU Retail POS app on your PAX machine.