Tax Reports

Once you’ve collected taxes it’s important to be able to accurately report on them. That’s why LOU has a few reports available.

Key Definitions

It’s important to make sure you understand the data in the reports. Here are some key LOU Definitions:

- Non-Taxable and Taxable: This refers to the SKU Types and whether they are taxable or non-taxable as defined in your Tax Nexus.

- Exempt: This is a Tax Code indicating that no matter what the SKU Type is, no tax can be collected. Often used in jurisdictions without Sales Tax or for Customers who are Tax Exempt. This is not the same as Non-Taxable, which is specific to SKU Type.

- Tax Authority: Governing body or entity to which you pay tax. Often Department of Revenue for City, County, or State.

- Tax Code: The effective Tax Rate which may be comprised of multiple Tax Authorities.

Go to Operations / Reports / Tax Reports

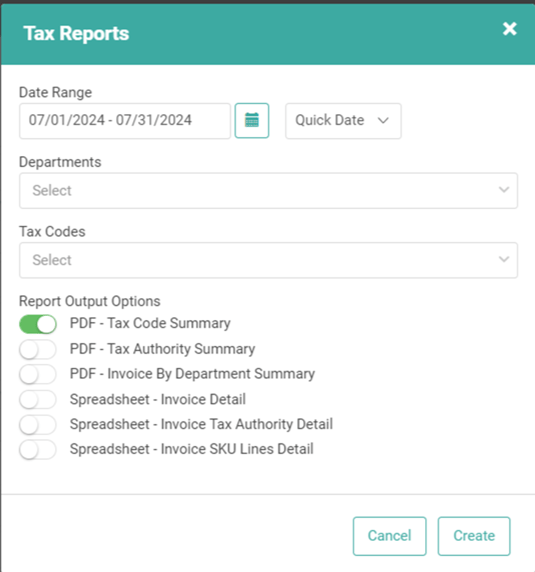

A pop-up will display, offering several report options.

- Determine the Date Range for your report – it will default to the previous month.

- You can select a Department to run the report for a single Department or leave it blank to run for all Departments.

- You can select a Tax Code to run the report for a single Tax Code or leave it blank to run for all Tax Codes.

- Select the Output and Report you want to run:

- PDF – Tax Code Summary gives you a summary of tax information by Tax Code.

- REMEMBER! You can have multiple Tax Authorities within a single Tax Code.

- PDF – Tax Authority Summary gives you a summary of tax information by Tax Authority.

- PDF – Invoice by Department Summary gives you a summary of tax information by Invoice and Department.

- Spreadsheet – Invoice Detail gives tax information in spreadsheet format, in detail by Invoice.

- Spreadsheet – Invoice Tax Authority Detail gives you tax information in spreadsheet format broken out by Tax Authority, rather than Tax Code, in detail by Invoice.

- Spreadsheet – Invoice SKU Lines Detail gives you tax information in spreadsheet format by Invoice and by SKU in detail.

- PDF – Tax Code Summary gives you a summary of tax information by Tax Code.

When reconciling these reports to the LOUs Reports / Invoices with SKUs report, it’s important to remember that a Tax Code may be made up of many Tax Authorities. Tax Amounts on Invoices in LOU are reflected as the total tax collected for that Tax Code.