Track and Reconcile ACH Payments

ACH Payments are unique because you don’t get the funds immediately. It takes the banks a few days to process the transfer of funds. This is why we recommend creating an ACH Clearing Asset account for your ACH Payment Method.

IMPORTANT! You should receive the money from ACH Payments within 1-5 business days, according to your bank’s processing times.

When ACH Payments are posted in LOU, the transaction will post to the ACH Clearing GL Account and the transaction will be considered Unsettled. Once the status updates to Settled, the ACH Clearing account can be zeroed out through the Bank Deposit process.

Tracking and reconciling these transactions is a little different from tracking transactions from other Payment Methods. LOU offers a few ways to track these ACH Transactions.

TIP! Since ACH transactions take some time to complete, we recommend confirming the transaction is settled and complete (you've received your money!) before delivering goods and services.

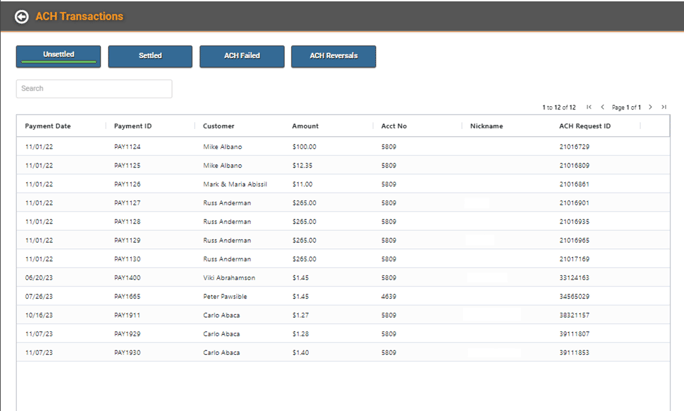

Go to Operations / Accounting / ACH Uncleared

Alternatively, you can access this page by going to an ACH Payment Profile and clicking ACH Clearing Search.

Whether you arrive here from a Payment Profile or by going through the Operations menu, this page is where you can search for ACH transactions. This page can be filtered, sorted, and exported like many other pages throughout LOU. Right-click anywhere in the data grid or click on the Column Headers to reveal actions you can take on this page.

- Unsettled: these transactions are processing, and the funds have not been transferred to your bank account yet.

- Settled: these transactions have finished processing, and the funds are in your bank account.

- Failed: these transactions were processed, but no funds were transferred.

- IMPORTANT! These Payments will be voided and the Invoice will be Pending. You must process a new Payment on the Invoice. We recommend requesting payment through a different payment method.

- Reversals: these transactions were processed and then reversed.

- These are payments you received through ACH and you are now processing a refund through ACH back to the Customer.

IMPORTANT! Currently, LOU does not support voiding an Unsettled ACH Payment. You must wait for the ACH Payment to settle before attempting to reverse or refund it.

The ACH Uncleared page is intended to provide you with a report on each of the transaction statuses above to help tracking, managing, and researching ACH transactions.

With the information in the reports above, you can reconcile your TSYS Merchant Account transactions and your bank account statement to ensure everything is balanced.

Go to Payments

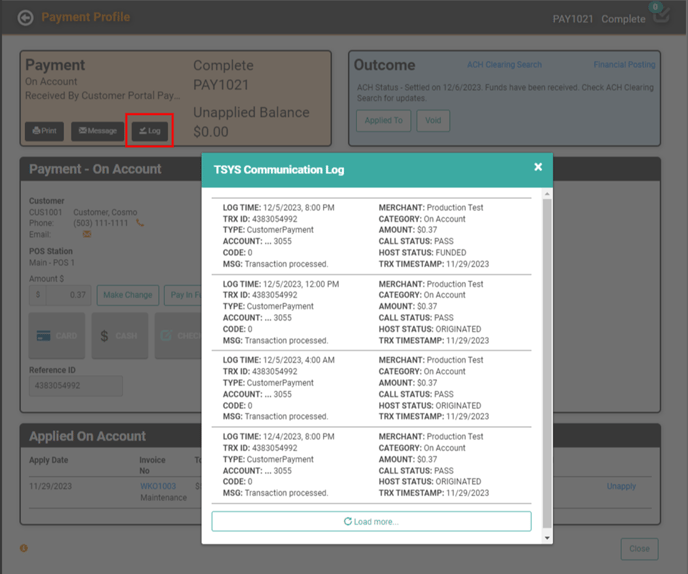

When viewing a Payment Profile for an ACH Payment, you can access additional information that may help with your reconciliation.

On the Payment Profile, click the Log button and a pop-up will display, giving you a log of communication with TSYS and the status of the transaction as it processes.

CheckCommerce Portal

Similar to your TSYS Merchant Portal, when you have ACH enabled you have access to the CheckCommerce Portal as well. When you log in, there is a summary of transactions and their status. You can use this page to compare transactions and confirm the payments' status on the merchant side just like credit card payments in your Merchant Center.

You can find a lot of helpful information on their Resource Center.

There are some differences in how CheckCommerce records statuses versus LOU.

|

Status on CheckCommerce |

Status in LOU |

|

Processing |

Unsettled |

|

Originated |

Unsettled |

|

Funded/Returned |

Settled |

|

BO Exception |

Failed |

|

Cancelled – (voided in CheckCommerce Portal.) |

Unsettled – (Not good! This payment is stuck as Unsettled and cannot be changed) |

|

Downloaded/BO Processing (in the middle of batch processing) |

Unsettled |

IMPORTANT! Currently, LOU does not support voiding an Unsettled ACH Payment. You must wait for the ACH Payment to settle before attempting to reverse or refund it.