General Ledger Beginning Balance Import

When you’re onboarding LOU Accounting, you need to make sure you get the important financials into LOU so that you can correctly calculate and report going forward.

Keeping in mind that LOU will be reporting and tracking your financials starting on the date you go live with LOU or go live with LOU Accounting (if you’re making the switch), there are some tools that allow you to capture some beginning balances that will be needed to accurately calculate balances in LOU. This import process allows you to make Journal Entries to fill in, or correct, General Ledger balances for any of your General Ledger Accounts.

Clients in Onboarding who are not yet transactional in LOU: you will have the opportunity to enter AR Beginning Balances, Customer Deposit Beginning Balances, Inventory Valuation, and AP Beginning Balances.

Clients transaction in LOU, making the switch to LOU Accounting: you have already done your AR Beginning Balances, Customer Deposit Beginning Balances, and Inventory Valuation. Through your LOU Accounting onboarding process, you will not go back and enter those again. However, you will enter AP Beginning Balances.

Whether you’re Onboarding LOU or just LOU Accounting, you may determine there are General Ledger accounts for which you want to create Beginning Balance Journal Entries for tracking and reporting in LOU. This General Ledger Beginning Balance Import is for you!

Rather than being true Beginning Balances, these are really journal entries allowing you make sure you’re tracking and reporting the correct balances within LOU starting on the day you go live.

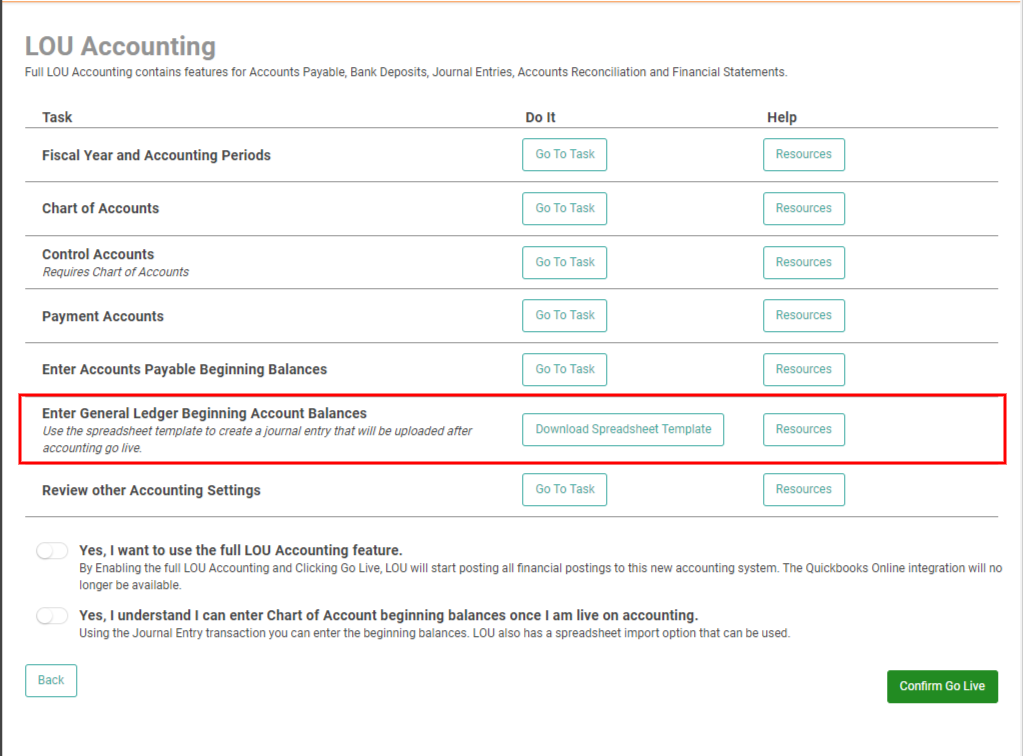

Go to Setup / Accounting / Enable Full LOU Accounting / General Ledger Beginning Balance

Click Download Spreadsheet Template.

IMPORTANT! You are downloading the template so you can work on populating it with data for the journal entries. You won’t be able to import it until after you’ve gone live on LOU Accounting.

Once you’re live on LOU Accounting, you’re going to take this completed spreadsheet and upload it following the Journal Entry Import process.

Keeping in mind that LOU will be reporting and tracking your financials starting on the date you go live with LOU or go live with LOU Accounting (if you’re making the switch), there are some tools that allow you to capture some beginning balances that will be needed to accurately calculate balances in LOU. This import process allows you to make Journal Entries to fill in, or correct, General Ledger balances for any of your General Ledger Accounts.

Clients in Onboarding who are not yet transactional in LOU: you will have the opportunity to enter AR Beginning Balances, Customer Deposit Beginning Balances, Inventory Valuation, and AP Beginning Balances.

Clients transaction in LOU, making the switch to LOU Accounting: you have already done your AR Beginning Balances, Customer Deposit Beginning Balances, and Inventory Valuation. Through your LOU Accounting onboarding process, you will not go back and enter those again. However, you will enter AP Beginning Balances.

Whether you’re Onboarding LOU or just LOU Accounting, you may determine there are General Ledger accounts for which you want to create Beginning Balance Journal Entries for tracking and reporting in LOU. This General Ledger Beginning Balance Import is for you!

Rather than being true Beginning Balances, these are really journal entries allowing you make sure you’re tracking and reporting the correct balances within LOU starting on the day you go live.

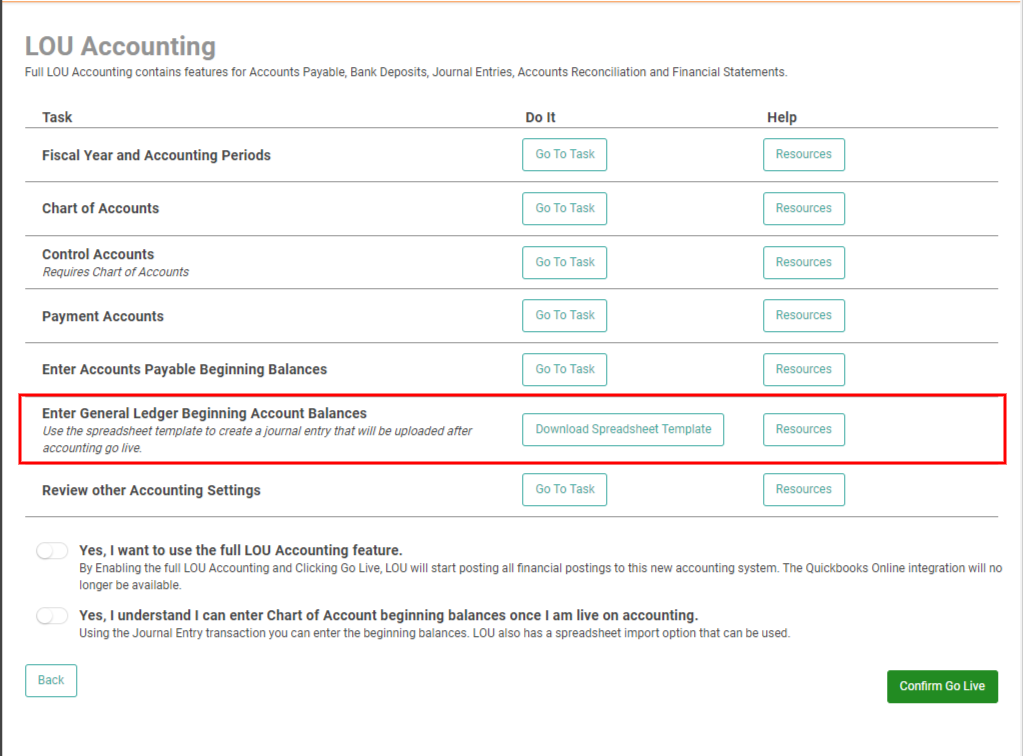

Go to Setup / Accounting / Enable Full LOU Accounting / General Ledger Beginning Balance

Click Download Spreadsheet Template.

IMPORTANT! You are downloading the template so you can work on populating it with data for the journal entries. You won’t be able to import it until after you’ve gone live on LOU Accounting.

Once you’re live on LOU Accounting, you’re going to take this completed spreadsheet and upload it following the Journal Entry Import process.