Account Reconciliation

Account Reconciliation is an important practice to ensure accuracy of your General Ledger and financial records such as account statements. This process proves that the transactions in an accounting period add up to the ending balance and are correct. In a nutshell, you’ll be balancing your GL to your actual bank balance.

TIP! We recommend performing a reconciliation of your bank statements and accounts outside of LOU prior to performing a reconciliation with LOU data. This will help ensure you’re getting an accurate picture of the data both in and out of LOU.

REMEMBER! This Account Reconciliation process is intended only for reconciling bank accounts. At this time, you cannot reconcile credit card accounts using this process.

Ideally, you should be performing an Account Reconciliation monthly as part of your month end processes, but you can run an Account Reconciliation any time.

Key Steps:

- Gather appropriate statements from your accounts (bank statements, card statements, etc.).

- Create Account Reconciliation for the corresponding GL Account in LOU.

- Apply transactions to Account Reconciliation.

- Research and resolve any variances.

- Complete Account Reconciliation.

- Print for your records.

Go to Accounting / Account Reconciliation

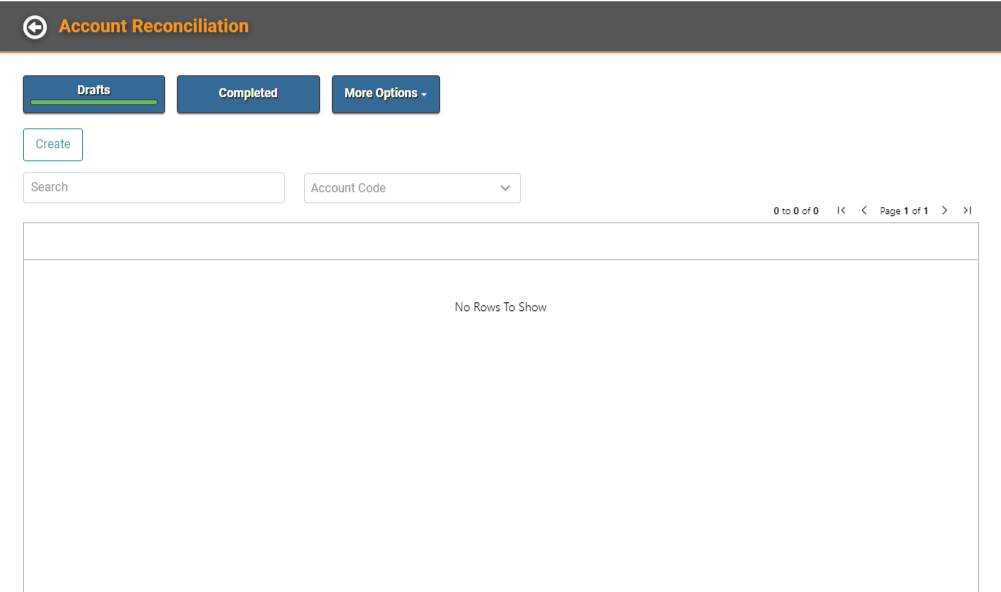

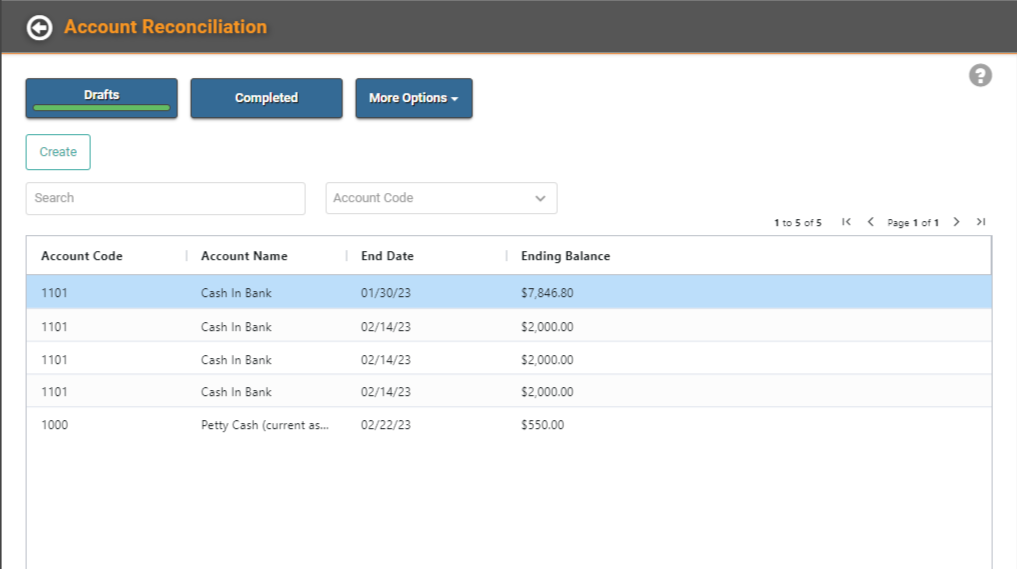

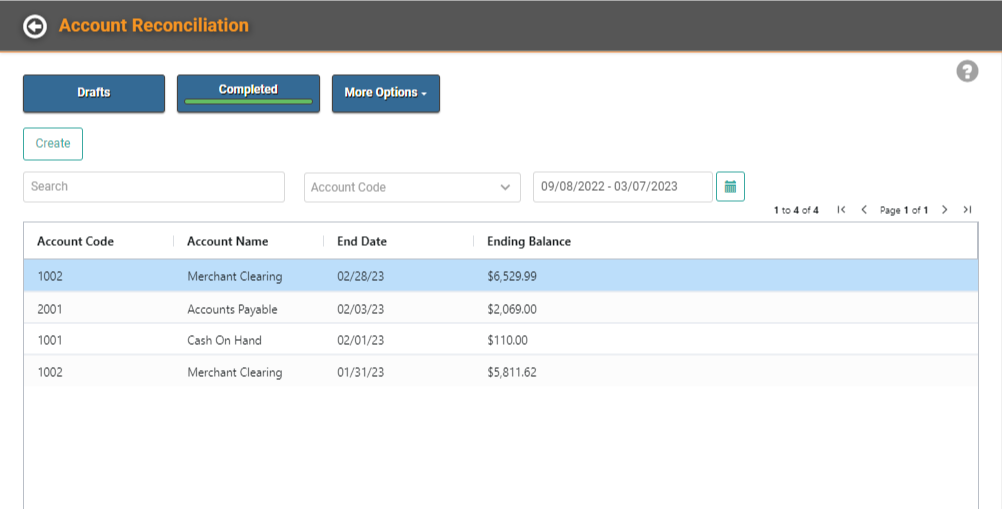

On the main Account Reconciliation page, you’ll land on Drafts, which is where you can create and edit Draft Account Reconciliations. You can also go to Completed to view your Completed Account Reconciliations or More Options to quickly access additional features relevant to Account Reconciliation activities.

IMPORTANT! Before you can create an Account Reconciliation record, you should have your bank or financial account statements available to compare. You’ll need the ending balance and date on those statements to enter in LOU.

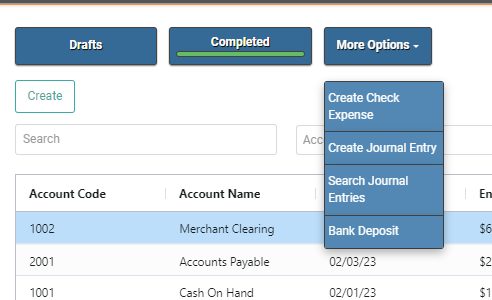

Create an Account Reconciliation

To create an Account Reconciliation, click the Create button.

Account Code: Choose the Account you want to reconcile.

Beginning Balance: LOU will pull the Beginning Balance as of the last Account Reconciliation (or all time if this is the first Account Reconciliation for the Account Code)

Ending Balance: You can enter an Ending Balance here or leave it 0.00 until you complete the Account Reconciliation.

Ending Date: Enter an End Date for the reconciliation.

You’ll be taken to the Account Reconciliation page where you can complete the reconciliation process.

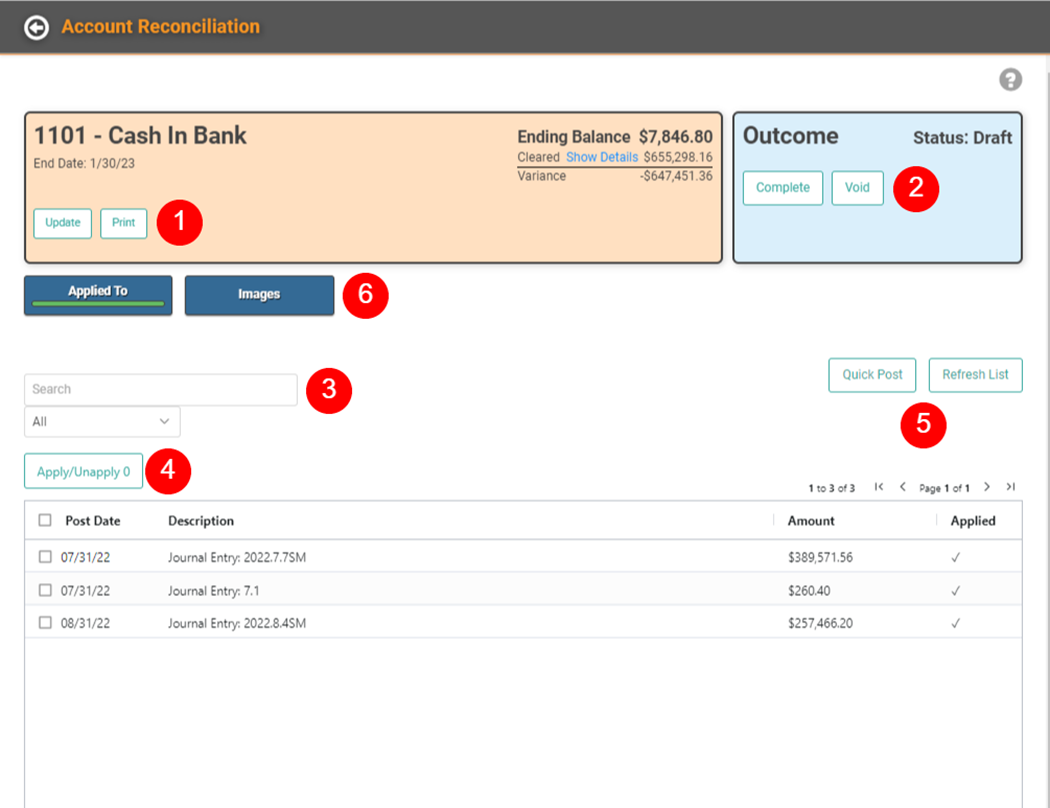

- You can Update the Beginning, Ending, and Ending Date details by clicking Update, but you cannot change the Account Code. You can also click Print this report to either physically print or save as a .pdf.

- Mark the Account Reconciliation as Complete or Void it.

- Search the Transactions listed. You can choose to filter by Increases or Decreases

- Choose which Transactions listed to Apply or Unapply to the Account Reconciliation.

- IMPORTANT! When selecting 500+ records, LOU will process in batches. A message will pop up indicating that LOU is processing the reconciliation and will email you when complete. LOU processes in batches of 500 and will email you once the complete number of records/batches has processed. No updates can be made to the Account Reconciliation while processing.

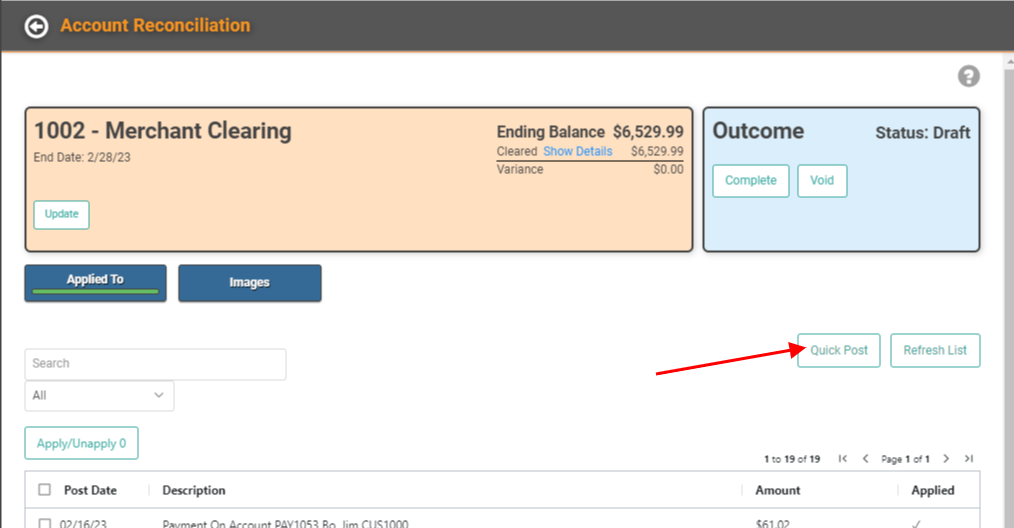

- If there is a variance you need to correct, you can use the Quick Post button to quickly post a Journal Entry and Refresh the list of transactions to Apply/Unapply. If you make a change, you can Refresh the list to ensure you’re looking at all the Transactions that should be included in the list below.

- You can attach Images to the Account Reconciliation.

Drafts

Account Reconciliations are created in Draft mode, allowing you to leave the page and return, as needed. An Account Reconciliation is not complete while it remains in Draft mode.

Apply/Unapply Financial Transactions

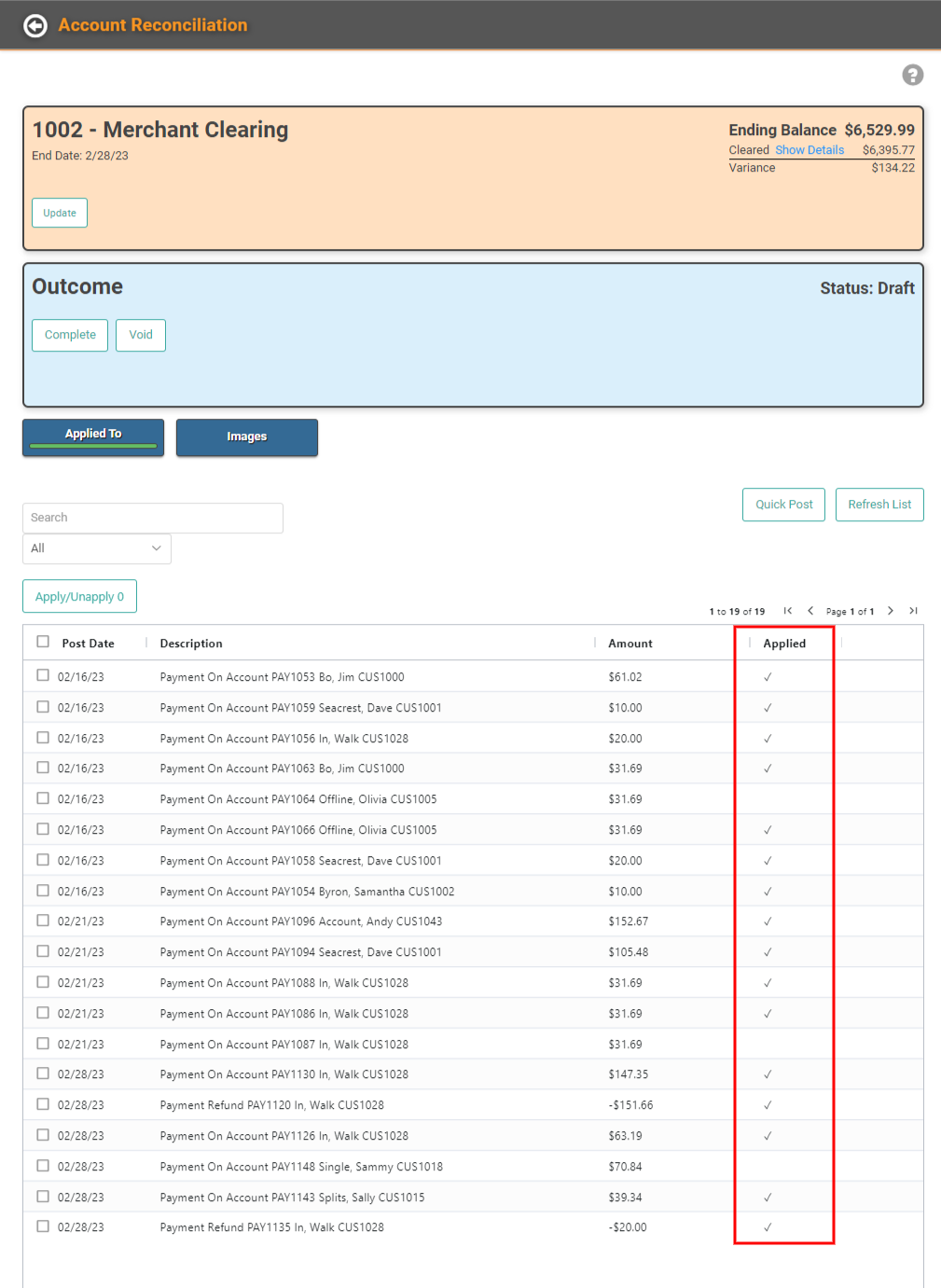

Most of the time, you’ll want to apply every transaction listed. However, there may be occasions where you are performing a recon for an ending date which includes transactions you don’t want to apply. For that reason, you can select all or select the ones you want to include before Applying.

After you apply, if you determine a transaction should not be included, check the box next to the transaction(s) and click Apply/Unapply to remove it. When you’ve applied a transaction to the Account Reconciliation, it will have a checkmark under Applied. If there is no checkmark, the transaction has not been applied to the Account Reconciliation.

Reconciling More than 500 Transactions

LOU will process reconciliations in batches of 500. When you select more than 500 records, LOU will give you a message indicating that the reconciliation is being processed and you will receive an email once it’s complete. You can continue working in LOU during this time. You will not be able to make changes to an Account Reconciliation currently being processed. LOU will give you a message letting you know that the reconciliation is being processed and no changes can be made. Once you receive the email, letting you know the process is complete, you can return to view the Account Reconciliation.

IMPORTANT! Internet speeds can impact how long it takes for LOU to fully process a large reconciliation. It may take several minutes for you to receive an email.

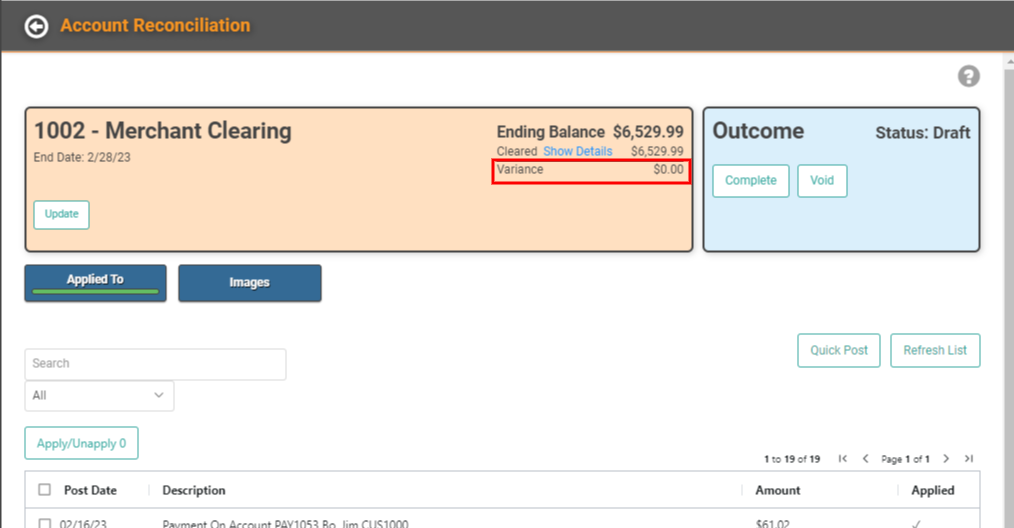

Ideally, once you’ve applied all the transactions you want to include, the Variance at the top should be 0.00

You can see the details of totals by clicking Show Details. A pop-up will break things out for you.

The Beginning Balance, Decreases, and Increases for the period between the last Account Reconciliation and the End Date for this Account Reconciliation, and the cleared balance which should be the sum of the transactions applied to this Account Reconciliation. This sum of transactions should match the Beginning Balance plus Increases, minus Decreases.

What if there’s a Variance?

If there’s a Variance, you may determine you want to create a Journal Entry. You can do that using the Quick Post button at the top of the Account Reconciliation Profile.

IMPORTANT! However, you may want to research the transactions listed and determine if there is an imbalance there before jumping to the Quick Post.

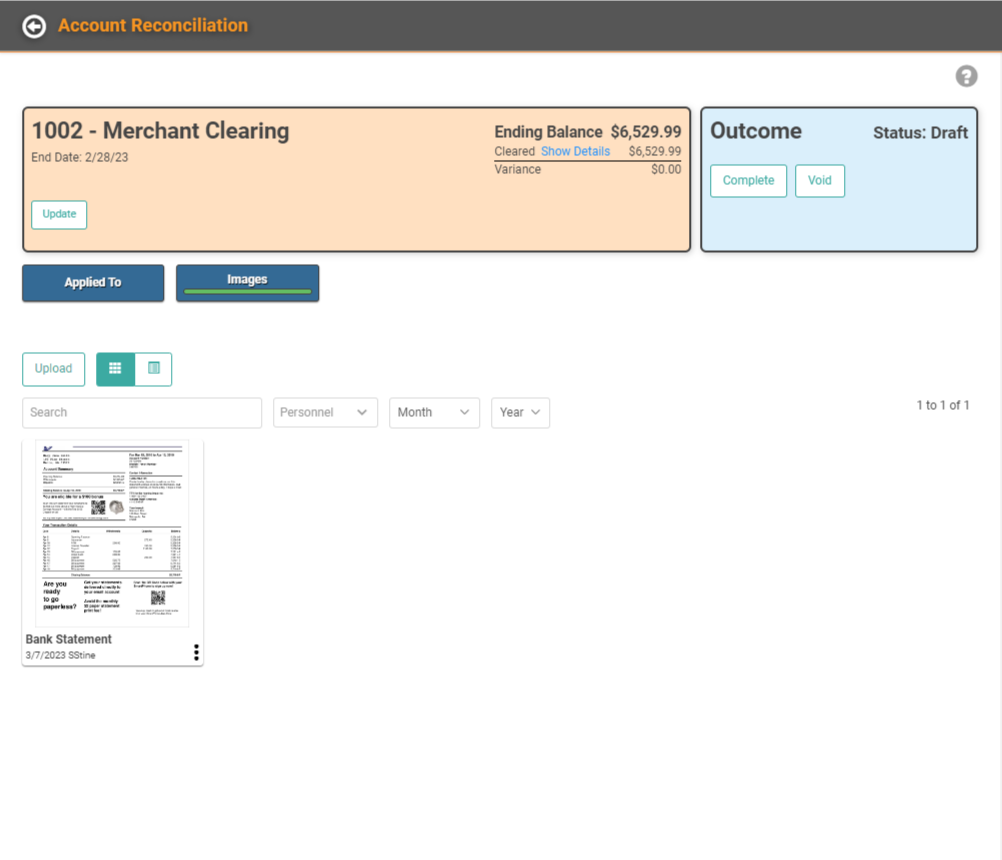

Images

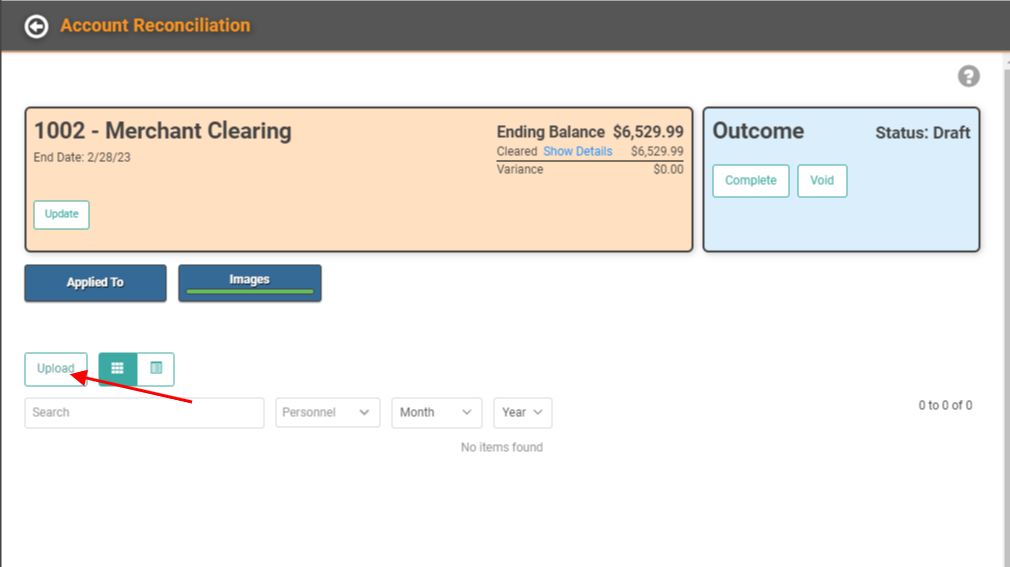

You can add images or files that can be referenced when looking at this Account Reconciliation.

IMPORTANT! Pictures and video must be less than 8mb. All other file types must be under 10mb. File sizes in excess will not be uploaded.

To add an image or file to the Account Reconciliation, you can click the Images button. Then click Upload.

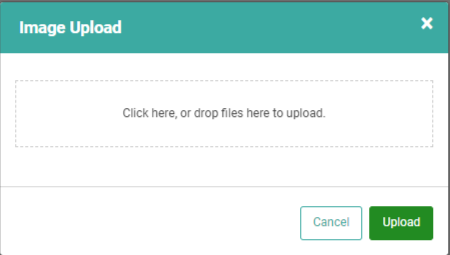

Drag and drop files from your computer to the pop-up or click the box to open a File Explorer and find the file you want to upload. Once selected, click Upload.

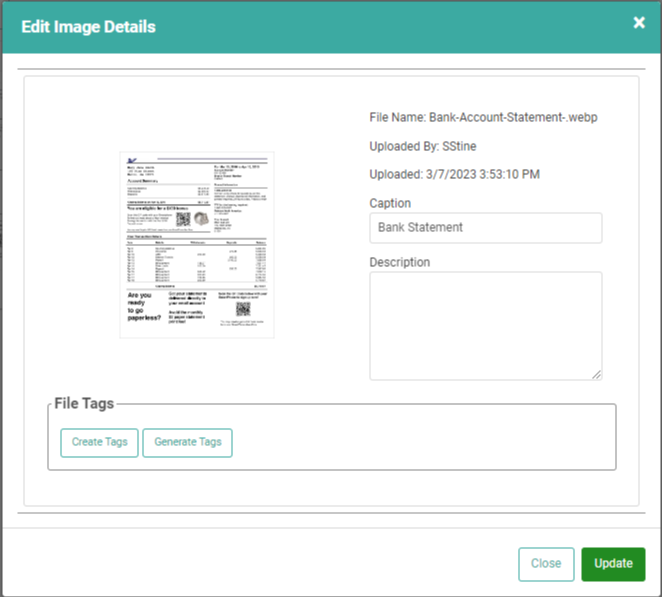

You can add a Caption or Comment, create Tags that make searching for the photos/files easier, and click Update when you’re finished.

A thumbnail of the image will appear on the Images page.

REMEMBER! These images do not appear anywhere else in LOU. You can find them any time by opening this Account Reconciliation and going to the Images button.

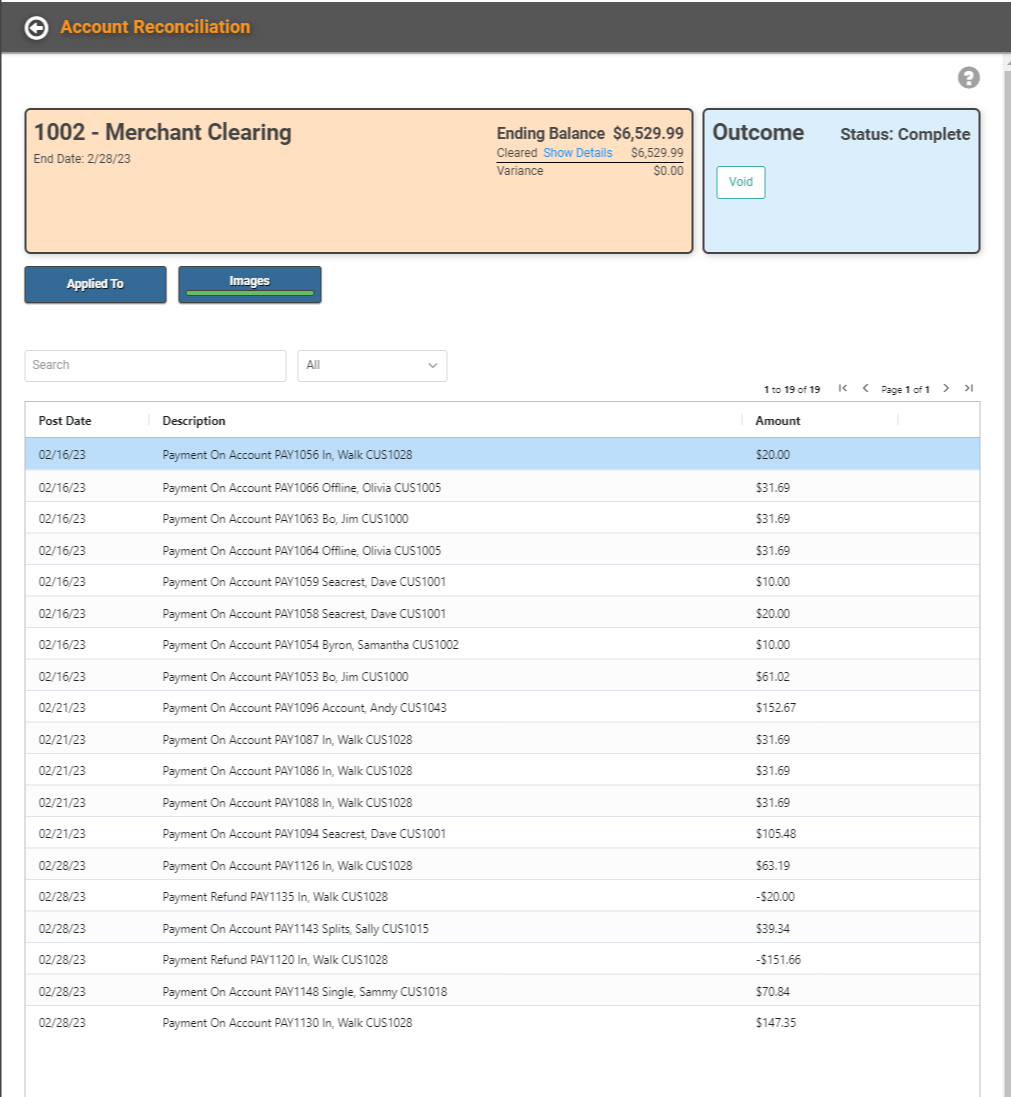

Complete the Account Reconciliation

Once you’re satisfied the Account Reconciliation is balanced, all variances are resolved, transactions are applied, and any relevant images and files have been attached, you can click the Complete button.

IMPORTANT! Once you complete an Account Reconciliation, it cannot be edited or changed. You can Void it, if necessary.

The Status will update to Complete and the Account Reconciliation will move from Drafts to Completed.

You can search previously completed Account Reconciliations to review.

REMEMBER! If you need to reconcile more than 500 records, LOU will process these in batches of 500 and email you once complete.