Fiscal Year and Accounting Periods

A Fiscal Year is divided into Accounting Periods. Accounting Periods are intervals during which financial activity takes place. The number of Accounting Periods in a Fiscal Year is determined by the type of Fiscal Year you choose to use for your Accounting.

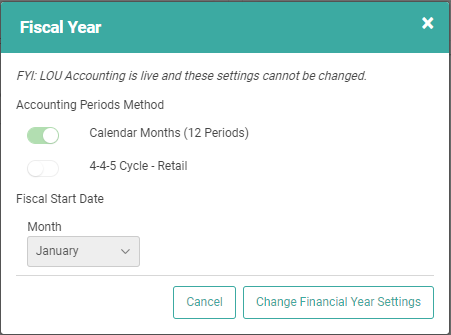

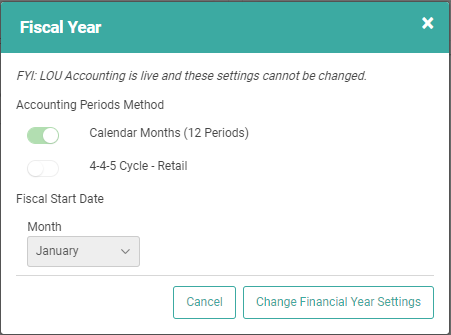

Calendar Months: This method uses standard Calendar Months to divide the Fiscal Year, creating 12 Accounting Periods.

4-4-5 Cycle: This method divides the Fiscal Year into four quarters. Each quarter is divided into two 4-week months and one 5-week month, hence 4-4-5.

Go to Accounting / Setup / Fiscal Year and Accounting Periods

Toggle either Calendar Months or 4-4-5 on and choose a Fiscal Start Date. The Fiscal Start Date is the first month of your Fiscal Year. For many, this may be January, but others may begin their Fiscal Year in July or October.

Once you’ve determined your Fiscal Year and number of Accounting Periods, you will not change them again. Doing so would have major financial consequences.

Accounting Periods will be created for each period in the Fiscal Year according to your selections, including past Accounting Periods. However, Accounting Periods cannot be reopened for any periods prior to your LOU Accounting Go-Live Date.

IMPORTANT! These settings should only be changed under the advice of an accounting professional.

Calendar Months: This method uses standard Calendar Months to divide the Fiscal Year, creating 12 Accounting Periods.

4-4-5 Cycle: This method divides the Fiscal Year into four quarters. Each quarter is divided into two 4-week months and one 5-week month, hence 4-4-5.

Go to Accounting / Setup / Fiscal Year and Accounting Periods

Toggle either Calendar Months or 4-4-5 on and choose a Fiscal Start Date. The Fiscal Start Date is the first month of your Fiscal Year. For many, this may be January, but others may begin their Fiscal Year in July or October.

Once you’ve determined your Fiscal Year and number of Accounting Periods, you will not change them again. Doing so would have major financial consequences.

Accounting Periods will be created for each period in the Fiscal Year according to your selections, including past Accounting Periods. However, Accounting Periods cannot be reopened for any periods prior to your LOU Accounting Go-Live Date.

IMPORTANT! These settings should only be changed under the advice of an accounting professional.